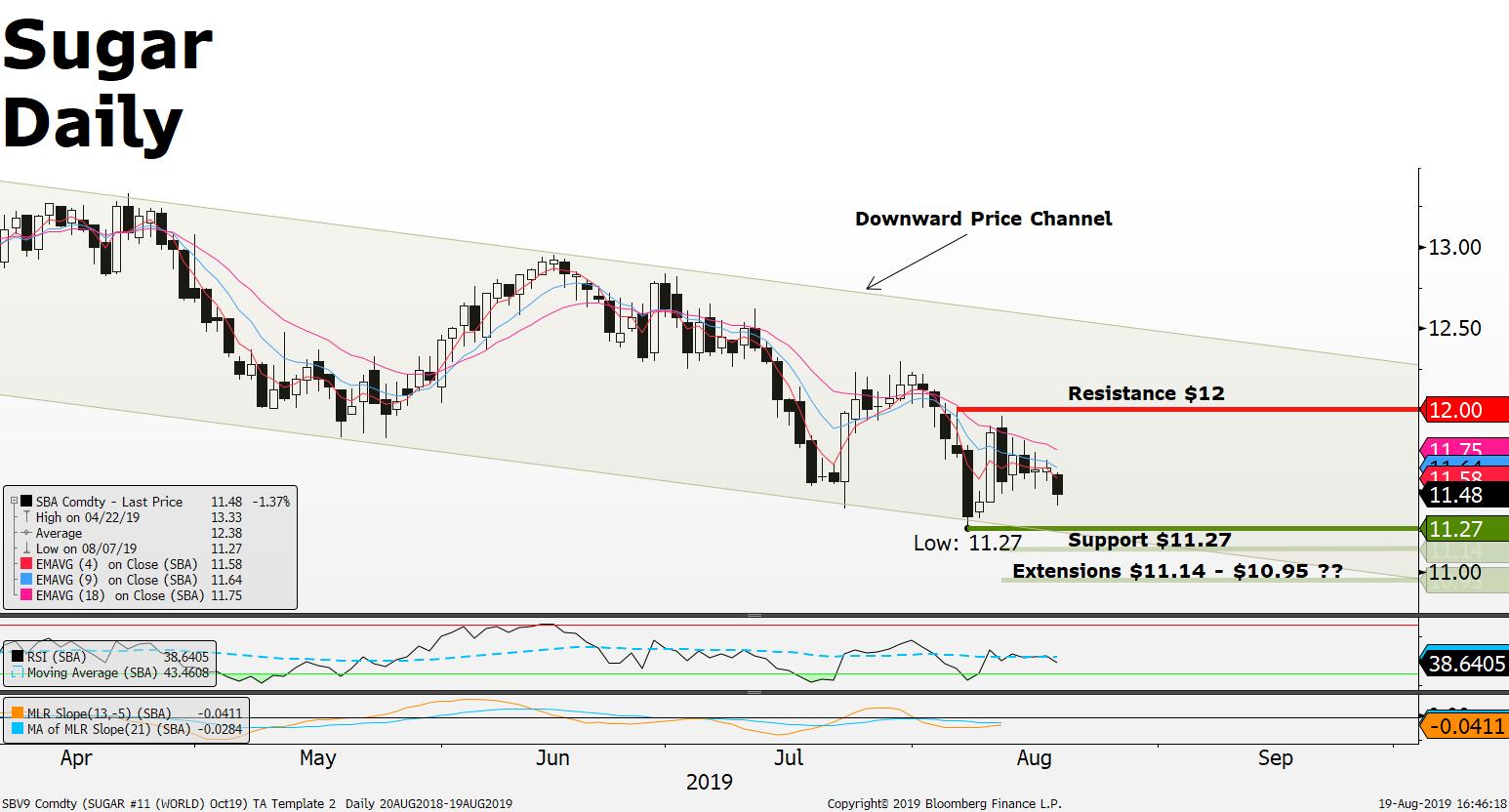

- Sugar price last week closed its longest run of weekly losses in more than two years;

- Sugar price down -12% last 30 days;

- The U.S.-China trade war is raising concerns about demand for soft commodities, including sugar

Sugar Price Drivers

- The main sugar producers are set for good harvests, but demand is looking less promising as fears of a slowdown in global economic growth hit markets;

- India a major Sugar producer, according to Bloomberg will produce 30 million tons of sugar this year, adding to potential downside price pressure for sugar if India's Sugar exports fall short;

- The Brazilian currency the Real; continues to be weak; this may act as a support for demand as foreign Buyers can expect to pay a lower cost on the back of a weak Brazilian currency;

- Brazil will also probably have a good crop year but demand is very poor as consumption trends in Brazil and rest of the world on the decline;

- Soft commodity investors/traders will be closely following the US Fed’s annual summit in Jackson Hole of Friday; any indication of a more aggressive interest rate policy (lower US interest rates) to hold off the possibility of a potential deep recession may cause high price action in the commodities markets;

Source: FXGM / Bloomberg