Global Market Insights:

When stock markets hit new all-time highs, investors start to get uncomfortable; be alert for possible selling pressure across European, American and Asian stock markets as investors may be seeking to take some profits off the table; any downside potential may create new opportunities for buyers to re-enter at lower prices; otherwise if no pullback happens to develop…upside momentum may just continue onwards….

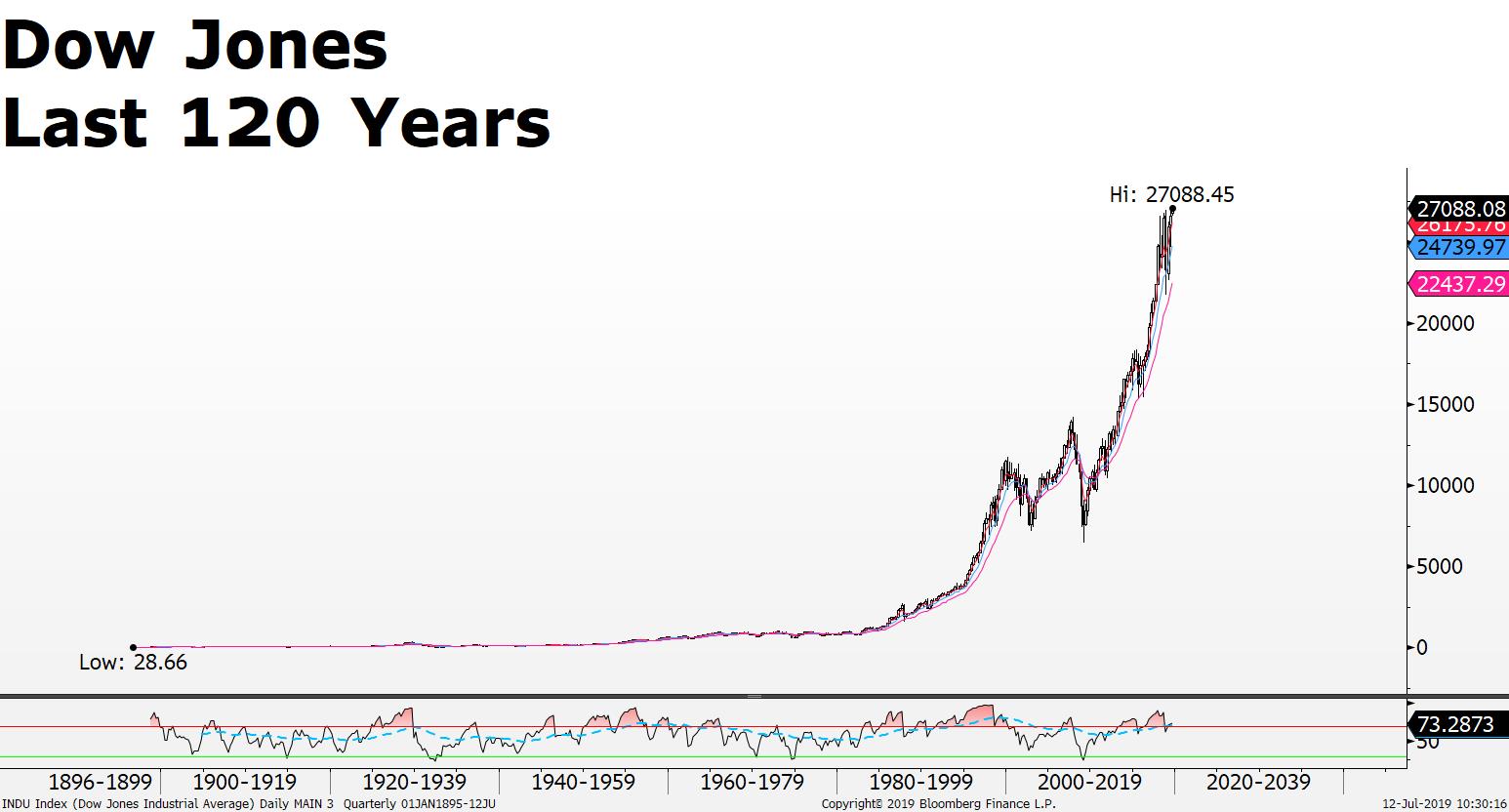

- US Dow Jones 30 stock index at historic all-time highs; low US unemployment; inflation under control and lower cost of borrowing on the way creates demand to buy stocks as corporate profits and US economic growth expected to get a boost on lower US interest rate prospects;

- European economies set to get a boost; the European Central Bank (ECB) Council agreed to prepare for adding further economic stimulus according to the latest release of the ECB Account of Monetary Policy Meeting;

Charts

Italy outperforms European stock indices; traders on alert for profit taking and a potential dip lower for the MIB after advancing +14% since May; European Central Bank (ECB) support to add economic stimulus pushes investors to add Italian stocks to portfolio’s on prospects Italy’s economy will recover; Italy’s MIB stock index current price 22,100 +8% last 30 days; next challenge for the MIB is to overcome the 22,205 high to open up potential for 22,600 price extension;

German DAX current price 12,309 trading below its short and medium term 4 and 9 period moving averages ; RSI crossed below its 70 signal line (bearish) indicates downside pressure; despite the current multi-month uptrend remains intact prices may fall lower towards the 12,340 – 12040 zone for buyer support before attempting to continue the current uptrend;

Upcoming Earnings

- Goldman Sachs reports on July 16th (Tuesday); forecasted to earn $5.212 per share (EPS) on $9.048.375 billion in sales;

FX Daily Trends

- GBP/USD potential upside break-out as price bounces off recent lows;

- EUR/USD remains in a multi-month weak uptrend;

- USD weakens; USD Index in multi-month downward price channel

Commodities Daily Trends

- Crude Oil (CL) facing resistance; upside momentum slowing; price looking for next catalyst;

- Platinum prices in weak uptrend; upside price momentum starting to increase;

- Gold price consolidating the May to June gains; price trading with $1,445 - $1.382 range until break-out in either direction

Source: FXGM / Bloomberg