The US Federal Reserve indicated a shift towards a lower interest rate policy; US FED seen shifting away from holding interest rates steady to increased chances of cutting interest rates as soon as July;

How Have Markets Reacted?

- Yesterday's US Fed move kicked off a selloff in the US dollar; drove Gold; Silver; Oil and stock markets higher;

- Technical momentum strategies appeared to have kick in pushing risk assets higher;

Charts

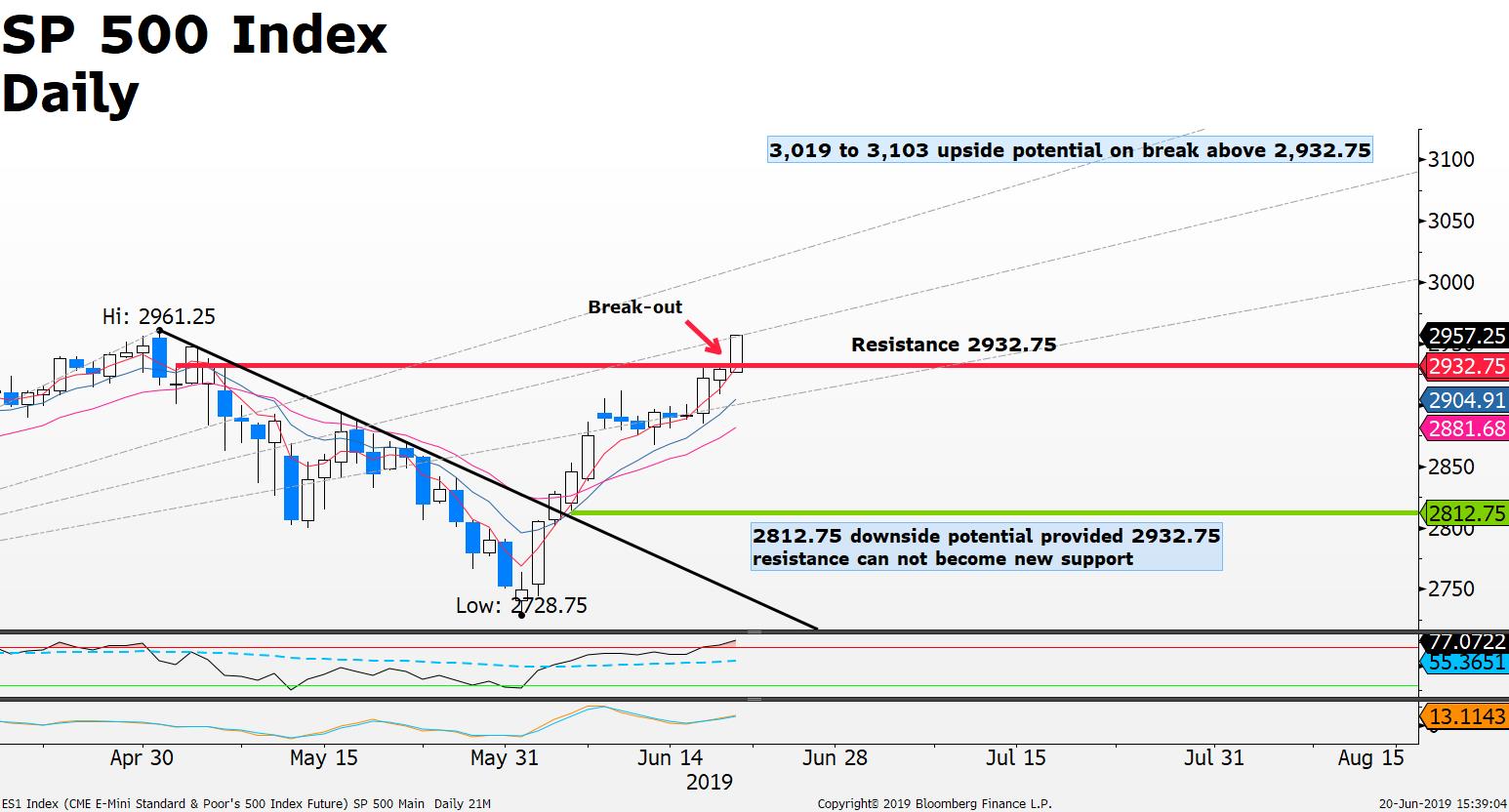

SP500 breaks above the 2932.75 resistance level; current price 2957.75; current break out could open up a further upside move provided 2932.75 can be established as a new support level; RSI crossed above its signal line indicating bullish upside momentum; current price is trading above its 4,9 and 18 period moving averages (Bullish); price extensions towards 3,019 and 3,103 can not be ruled out provided 2961.12 (previous high) is overcome; otherwise price may consolidate between 2932.75 and 2961.25.

Precious Metals breaking higher on lower USD and Euro interest rate prospects; safe haven demand; and trade war concerns; lower USD interest rate prospects adds downside pressure on the US dollar making Gold and Silver more attractive for non-USD investors; Current Gold prices trading above current uptrend line (Bullish); RSI analysis is bullish since RSI is above its signal line; moving average analysis is bullish since current price is above its 4,9 and 18 period moving averages;

Crude Oil prices (CL) +6.22% higher last 5 days on prospects that global demand will improve as international Central Banks take action to offset the negative economic effects of the US - China trade war and tensions between Iran and the US after Iran shot down a US military drone; Crude Oil (CL) current price $56.11 testing the $55.85 resistance level ; provided price can hold above resistance a move towards the $60 resistance cannot be ruled out; otherwise a retest of the $50.20 support remains.

Source: FXGM / Bloomberg