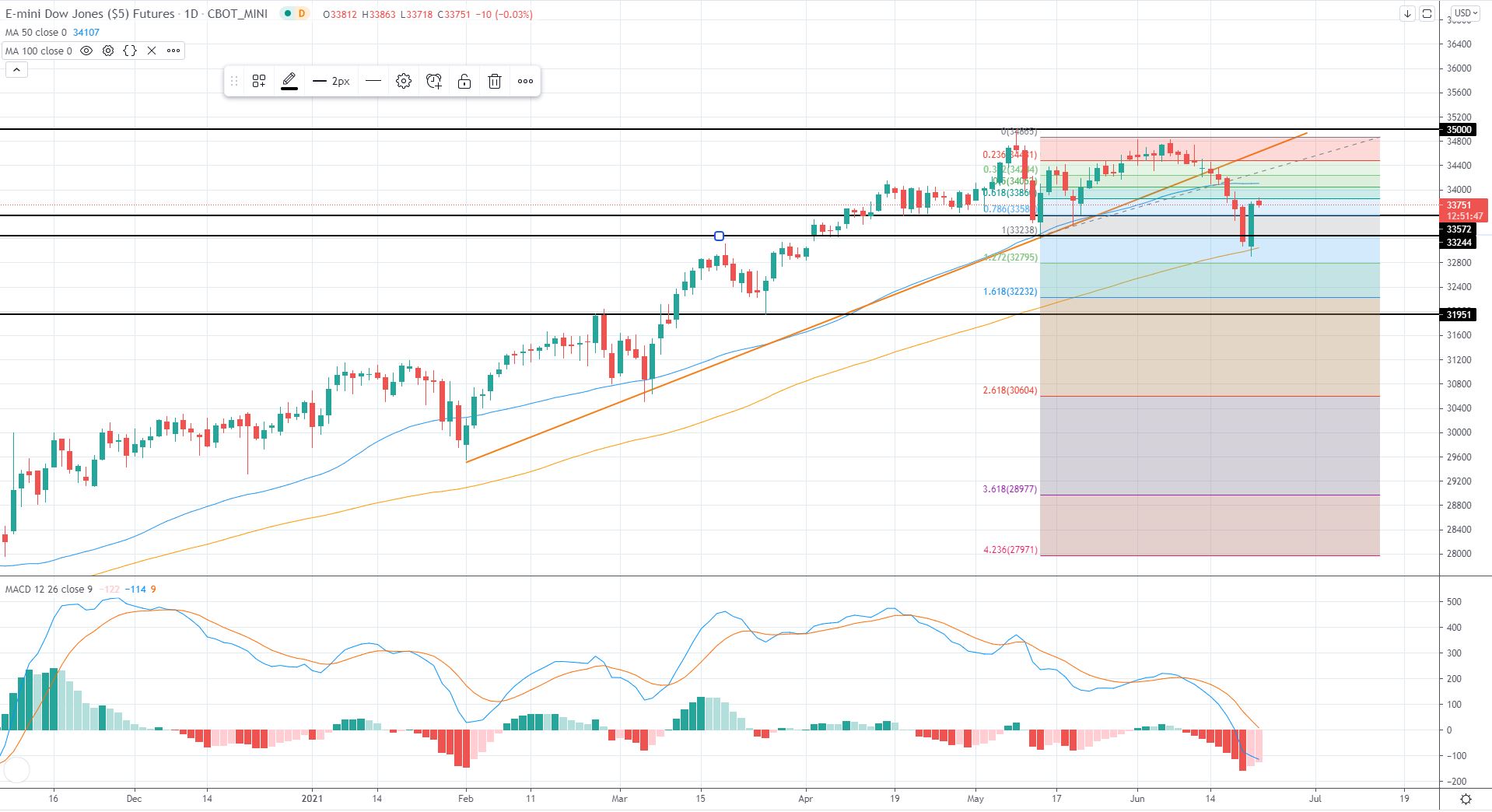

For the bulls, important resistance points at 34100.00 where the MA50 stands now, and also at 35000.00 from the May 10th all time high.

For the bears, important support exists at 33570 from the bottom of May 13th, also at 33010 where the MA100 stands now and finally at 31951.00 derived from the March 25th bottom.

It’s a quiet day ahead on the US economic calendar. Any market direction will come from FED Chair Powell testimony after the European close will be a factor to consider.

• U.S. stocks were higher after the close on Monday, as gains in the Oil & Gas, Financials and Basic Materials sectors led shares higher.

At the close in NYSE, the Dow Jones Industrial Average added 1.76%, while the S&P 500 index added 1.40%, and the NASDAQ Composite index climbed 0.79%.

• The U.S. economy continues to show "sustained improvement" from the impact of the coronavirus pandemic and ongoing job market gains, but inflation has "increased notably in recent months," Federal Reserve Chair Jerome Powell said in prepared testimony for a congressional hearing on Tuesday.

Powell did not go into detail in his prepared remarks on current monetary policy, or on the possibility the U.S. central bank may have to speed up its plans to pull back on some support for the economy because of the faster rise in prices.

• Oil prices soared on Monday, gaining on a pause in talks to end U.S. sanctions on Iranian crude, and as the dollar retreated from two-month highs.

Brent crude for August gained $1.39, or 1.9% to settle at $74.90 a barrel. U.S. West Texas Intermediate (WTI) crude for July gained $2.02, or 2.8%, to end at $73.66.

• Corn futures ended the Monday session with a 4 cent gain in July, accompanied with 9 1/4 to 9 1/2 cent new crop losses. The delayed CFTC report showed long liquidation reduced managed money’s net long in corn by 22,689 contracts to 252,730 as of 6/15. Commercials also reduced exposure through the week ending 6/15.

• At 14:00 (GMT) US Existing Home Sales will be announced. This report is a reflection of the annualized number of residential buildings that were sold during the previous month, excluding new construction.

• At 14:00 (GMT) US Richmond Manufacturing Index coming up. This is a survey of about 55 manufacturers in the Richmond area which asks respondents to rate the relative level of business conditions including shipments, new orders, and employment.

• At 15:00 (GMT) US Federal Reserve Bank of San Francisco President Mary Daly is due to speak at an online event hosted by the Peterson Institute for International Economics. Audience questions expected.

• At 18:00 (GMT) Federal Reserve Chair Jerome Powell is due to testify on the Fed’s emergency lending programs and current policies before the House Select Subcommittee on the Coronavirus Crisis, via satellite.

US Indices yesterday:

• Dow Jones +1.76%

• S&P 500 +1.40%

• Nasdaq +0.79%

Sources: Investing.com, forexfactory.com, barchart.com