Global Market Insights:

- Crude Oil pushing to test $60.50 resistance; current price $58.80 +4.5% last 5 days; tight supply supporting price as US crude inventories seen falling and Middle East troubles remain.

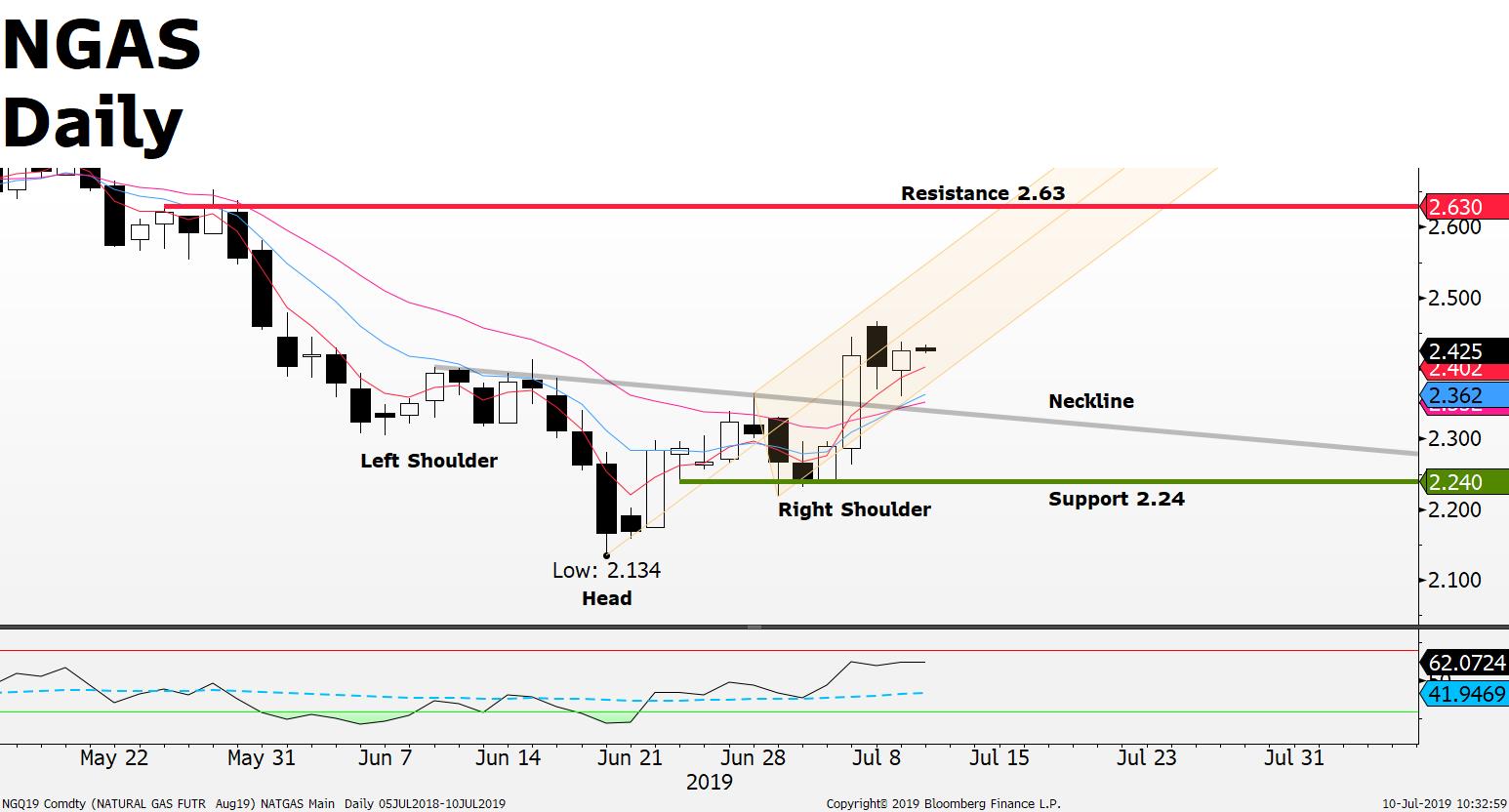

- Natural Gas prices +8% last 5 days; current price $2.423; resistance $2.63; warm weather across the Eastern and Western parts of the US supporting natural gas demand as power stations increase output to support energy needs.

- Norway missed inflation forecast; USD/NOK + 1.7% last 5 days; current price 8.6568; price has advanced above key resistance; further upside potential.

- EUR/GBP heading for + 70 pips upside move? GBP near two year low on speculation UK will cut interest rates; current price 0.8972 +1% last 5 days; resistance ahead near 0.908.

- DAX further downside before support? DAX gives back -185 points after advancing +3.34% last 30 DAX; profit taking could be seen as the driver for the pullback; current price 12,416; buyers support seen lower between 12,271 and 12,040.

Day Ahead

- U.K. GDP;

- Canada Interest Rate decision;

- US Federal Open Market Committee (FOMC) Meeting Minutes;

- US Fed Chairman Testifies;

- Levi Strauss & Co. earnings;

- Crude Oil Inventories due;

Tomorrow

- European Central Bank (ECB) Publishes Account of Monetary Policy Meeting;

- US Core Consumer Price Index (CPI);

Upcoming Earnings

- Goldman Sachs reports on July 16th (Tuesday); forecasted to earn $5.212 per share (EPS) on $9.048.375 billion in sales;

Charts

Natural Gas prices +8% last 5 days; current price $2.423; resistance $2.63; warm weather across the Eastern and Western parts of the US supporting natural gas demand as power stations increase output to support energy needs. Technical Commentary: Natural Gas (NGAS) breaks above the neckline of a heads and shoulders reversal pattern; current price 2.425; upside 2.63; downside on break below the pattern neckline 2.24 (see NGAS chart above)

German DAX current price 12,402 trading below its short and medium term 4 and 9 period moving averages ; RSI crossed below its 70 signal line (bearish) indicates downside pressure; despite the current multi-month uptrend remains intact prices may fall lower towards the 12271 – 12040 zone for buyer support before attempting to continue the current uptrend;

Crude Oil Prices attempting to test the $60.50 resistance; a break above the multi-month down trendline opens up potential for further price advance; support $56.60; RSI upside momentum increasing;

EUR/GBP trending higher; current price 0.90031 trading within its multi-month uptrend channel; upside resistance seen at 0.908; moving average analysis is bullish since price is trading above its 4,9, and 18 periods; support near 0.8870 to 88.

USD/NOK breaks above key resistance 8.63; current price 8.6611 + 91 pips last 5 days; the break above 8.63 opens up potential for a further advance; however with the prospects of a NOK interest rate increase short sellers may be betting on a return to the lower end of the multi-month trading range near the 8.4250’s; upside potential on 8.63 break 8.80 to 8.90; downside on a failure to hold above 8.63 near the 8.4250 support; upside supported;

Source: FXGM / Bloomberg