Week Ahead

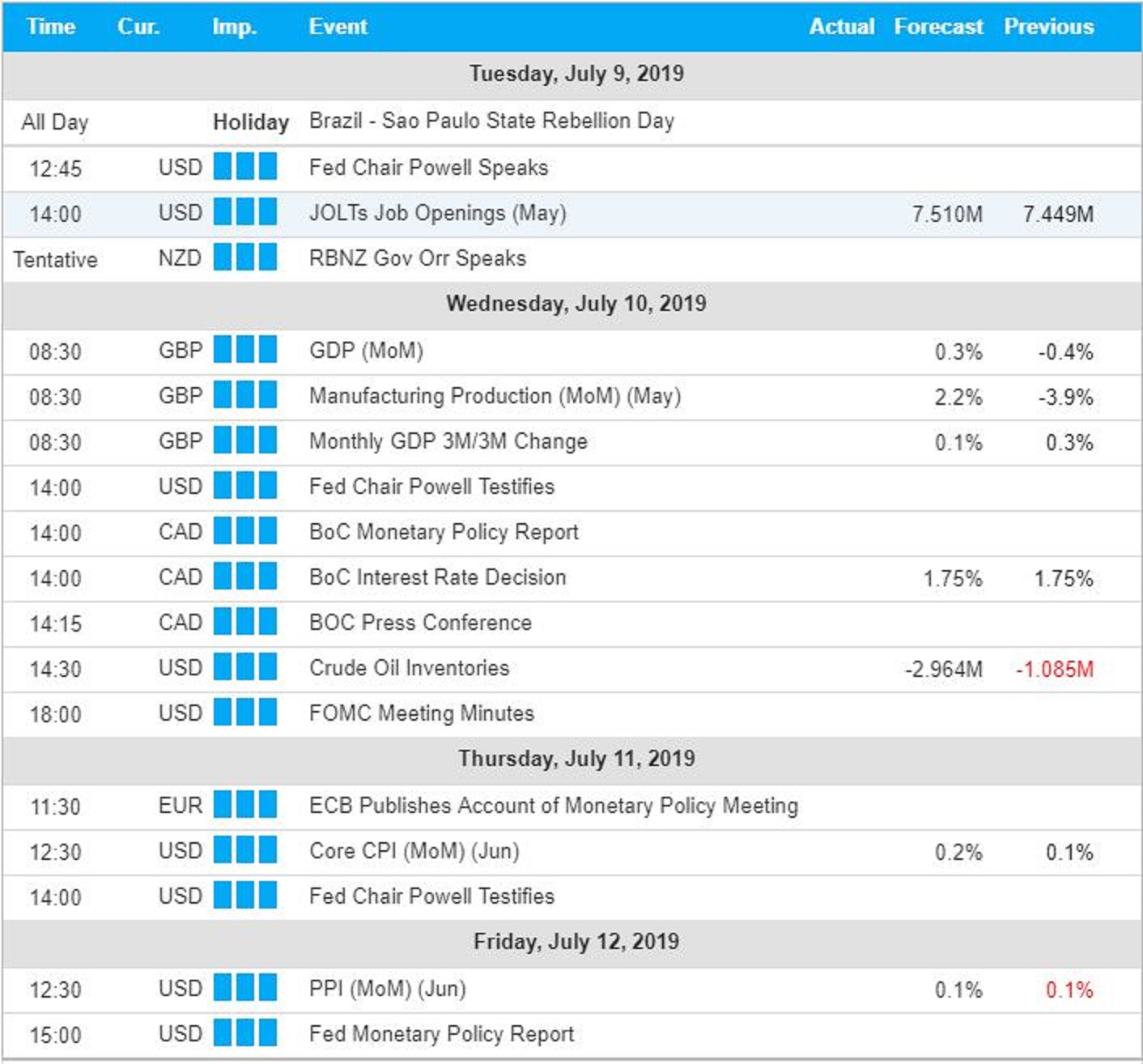

- US Fed Chairman Powell due to speak on Tuesday;

- U.K. GDP; Canada Interest Rate decision and US Federal Open Market Committee (FOMC) Meeting Minutes; Levi Strauss & Co. earnings and Crude Oil Inventories due Wednesday;

- Thursday European Central Bank publishes Monetary Policy Meeting;

- Friday US Fed Monetary Policy Report due;

Upcoming earnings:

- Tuesday after market close Levi Strauss & Co. earnings due; forecast to earn $0.125 cents per share on $1.293 billion in sales over the last 3 months; current price $22.23; 12 month target is $25 according to Bloomberg analyst consensus;

Trending

- Norwegian Krone in focus; Norway Norges Bank may move to raise interest rates in September; USD/NOK at key resistance ; current price 8.6274 + 45 pips last 5 days; a break above 8.63 opens up potential for a further advance; however with the prospects of a NOK interest rate increase short sellers may be betting on a return to the lower end of the multi-month trading range near the 8.4250’s; upside potential on 8.63 break 8.80 to 8.90; downside on a failure to hold above 8.63 near the 8.4250 support;

- Crude Oil (CL) +11% last 30 days; OPEC + Russia production cuts seen as offering price support; current price 57.60; supports at 56.60 and 53.50; resistance at 60.50 and 63.60; upside momentum remains intact since RSI crossed above its signal line (30) while current price is holding above RSI 14 period moving average; trend analysis (daily chart) indicates a weak multi-month downtrend; a break above the downtrend line opens up the prospects for higher prices while buyer support looks firm between the 56.60 to 53.50 zone;

Source: FXGM / Bloomberg