FX Market Update

Big price action across FX markets; US dollar falls on expectations of pending US interest rate cut

- USD weakening after yesterday’s US Fed FOMC Meeting Minutes indicated high chance of interest rate cut this month;

- EUR/USD + 90 pips last 3 days; attempting to re-start uptrend; current price 1.1273; upside potential 1.1450; downside 1.1150;

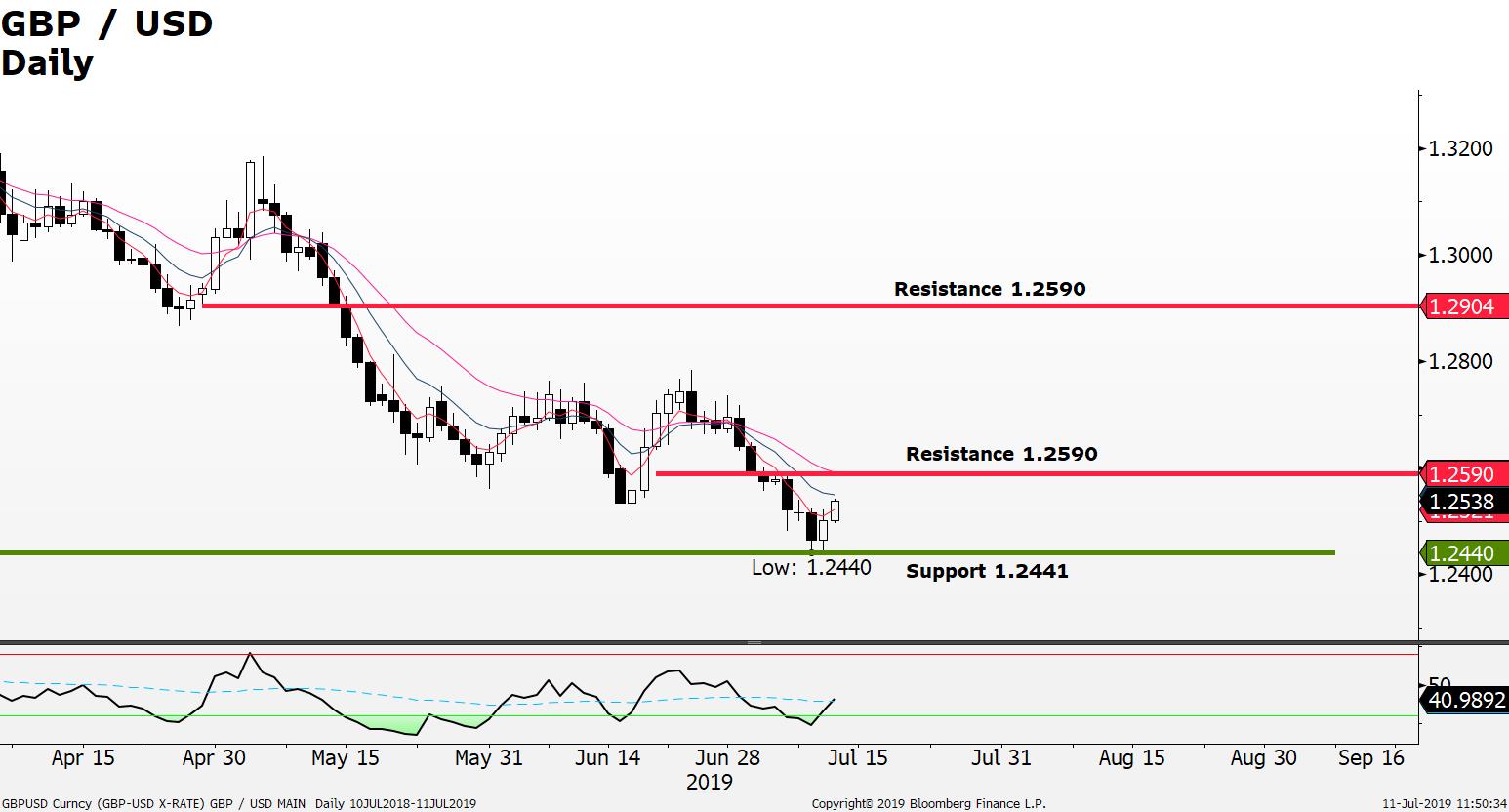

- GBP/USD bounces +100 pips off two year low; 1.2440 support; current price 1.2535; the pair looks to be aiming for a test of the 1.2590 resistance; prospects Boris Johnson may be next UK Prime Minister also helping to lift the GBP/USD;

Charts

GBP / USD finds support at 1.2440; current price at 1.2538 aiming to challenge the 1.2590 resistance; a break above could result in momentum trading higher provided 1.2590 can managed to be established as new key support; downside risk remains provided price fails to hold above the 1.2440 support;

EUR/USD attempting to re-start multi-month uptrend; the fact the price has re-entered the uptrend price channel (see chart) and that price is trading above its 4,9 and 18 period moving averages indicates that price may be attempting to re-start the prevailing uptrend; supports at 1.1190 and 1.1150; upside seen near 1.1450 provided price can hold above supports;

Source: FXGM / Bloomberg