Strong US dollar can damage US businesses; technology companies with big sales in non-USD currencies seen to take a negative hit;

- US Dollar trending higher after US disappoints with an unclear message about future interest rate decisions; US dollar index +2.88% last 30 days; (massive move for a major currency to move near +3% in 30 days);

- Gold price sells-off as the USD regains strength; gold price may find buyers support within the $1,410 to $1,385 zone;

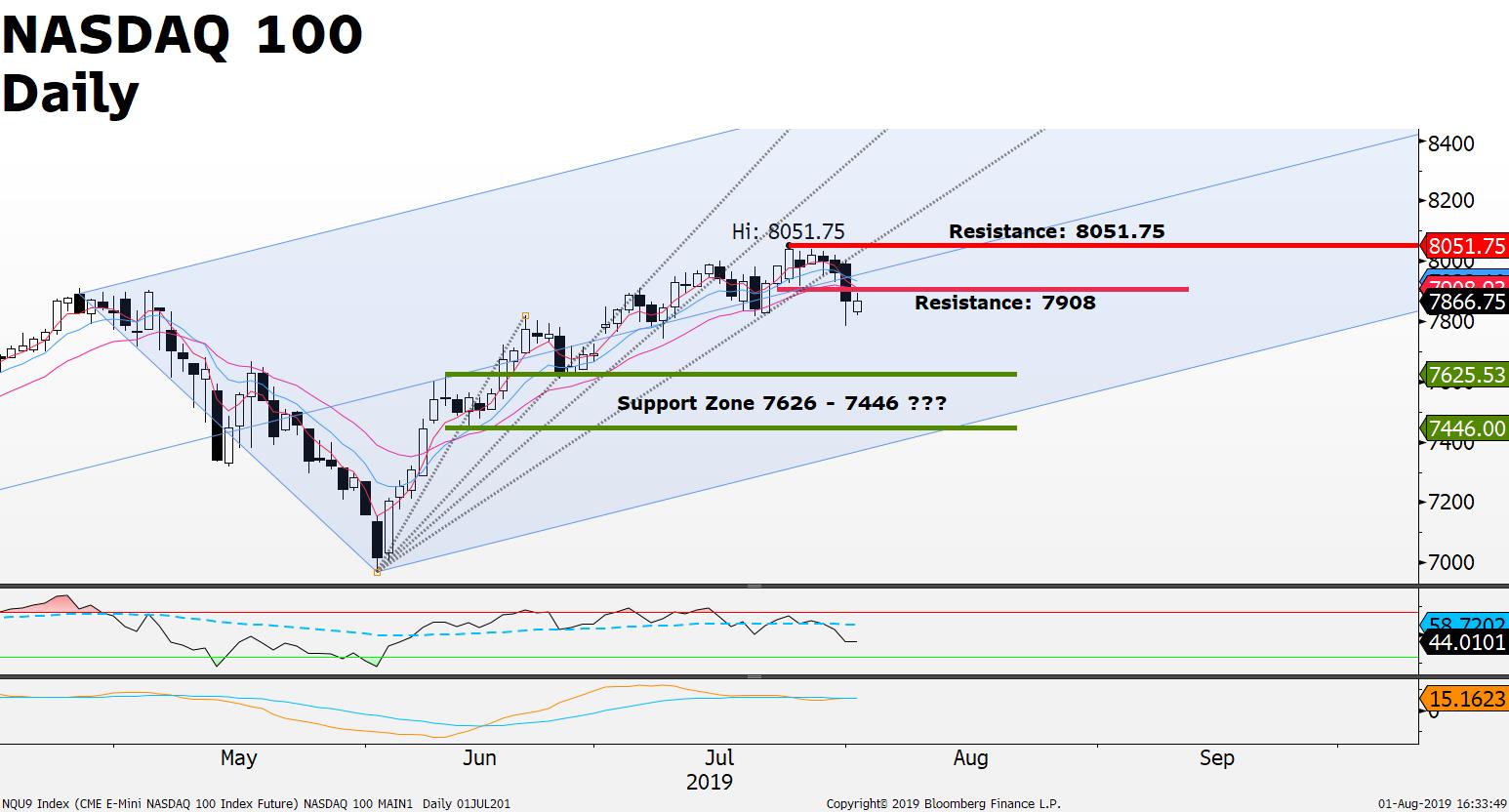

- NASDAQ 100; breaks below key support (bearish); Dow Jones 30 bearish signals; potential downside to continue;

- Crude Oil (CL) Bearish signs; price fails to break and hold above the $58.50 resistance; current price $57.60 down -1.6% for the day; further downside for Crude Oil to reach the $53.70 support looks likely provided price remains under the $58.50 resistance;

- Natrual Gas bullish signs; Natural Gas Good reward risk ratio? Upside +11% / Downside -3.3% ; hotter temperatures create increase demand for Natural Gas; the fact that price has reacted to strong buying support within the 2.22 - 2.159 support zone along with the bullish engulfing candlestick pattern created near the support levels may be an early indication that the longer term downward trend is about to reverse higher; current price 2.30 +3% for the day; upside seen at 2.49; downside 2.159,

- UK leaves interest rates unchanged at 0.75%; GBP/USD breaks below key support potential open for -220 pip price drop to the 1.1860 extension;

Source: FXGM / Bloomberg