Global Market Insights:

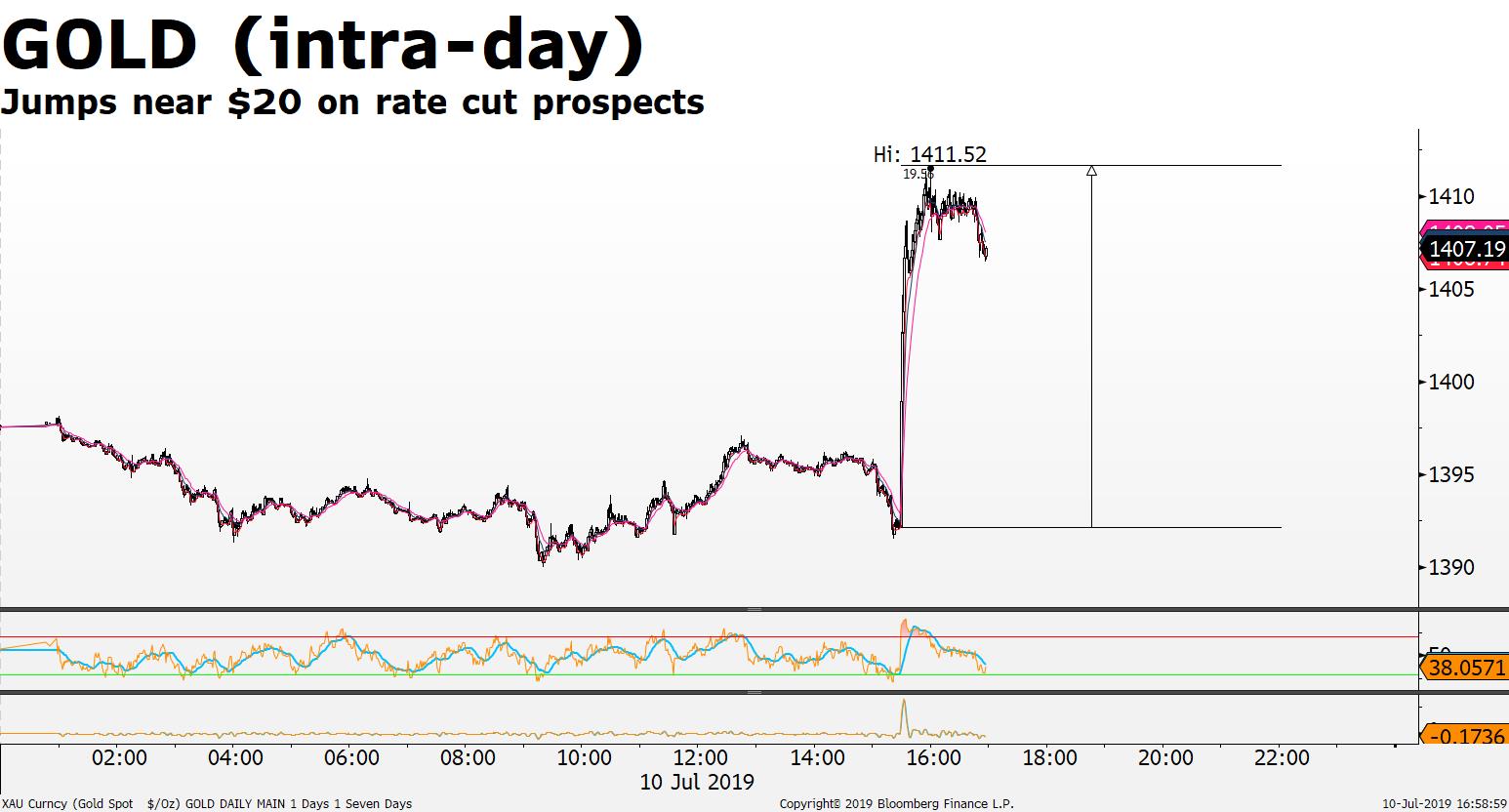

- US Stock Index futures and commodities prices jump higher; Dow Jones; SP500; NASDAQ 100 take aim on next leg higher to new all-time record highs; precious metals and crude oil higher on weaker US dollar; traders betting on US July interest rate cut;

- US Federal Reserve Chairman signalled interest rate cuts sooner rather than later; triggered the US dollar to fall and stock and commodities to advance higher;

- US Fed Boss announcing that economic uncertainties holding down the economic outlook for the US economy; traders and investors view this as a major clue that the US Fed will make a move to lower US interest rates this month;

Trending

- Gold prices jump +$12; current price $1,409; weaker US dollar and lower US interest rate prospects supporting the move higher; resistance $1,445; support $,1382

- Crude Oil (CL) traders should be alert that current price at $59.45 is trading below the $60.50 resistance ; price +2.8% on the day on reports that US inventories may fall; a failure for price to break and hold above the $60.50 resistance may bring out short sellers to test the $56.60; otherwise a break above the $60.50’s opens up a further advance towards $63.60;

- GBP/ USD bounces off support gains +50 pips as the US dollar weakens against the majors; current price 1.2513; resistance 1.2590; RSI indicating early sign of a potential downside trend reversal;

- Dow Jones 30 current price 26,940; +126 points on speculation US interest rate cuts are on the way this month; prices needs to clear above the 27,000 resistance in order to re-start the prevailing multi-month uptrend;

- SP500 attempting to test the 3006 highs; current price 2999; a break above opens up 3,019 to 3,103 as next leg up;

- Natural Gas prices +9.4% last 5 days; current price $2.457; resistance $2.63; warm weather across the Eastern and Western parts of the US supporting natural gas demand as power stations increase output to support energy needs. Technical Commentary: Natural Gas (NGAS) breaks above the neckline of a heads and shoulders reversal pattern; current price 2.457; upside 2.63; downside on break below the pattern neckline 2.24

Tomorrow

- European Central Bank (ECB) Publishes Account of Monetary Policy Meeting;

- US Core Consumer Price Index (CPI);

Upcoming Earnings

- Goldman Sachs reports on July 16th (Tuesday); forecasted to earn $5.212 per share (EPS) on $9.048.375 billion in sales;

Source: FXGM / Bloomberg