Dow Jones jumps + 2000 points last 15 trading days

Short term downside correction is due?

- Dow Jones rate of move may be seen as too far too fast and price may have to correct (retrace lower) before resuming its longer term uptrend

- Increased geopolitical tensions after Saudi Arabia Oil attacks adding to help support a price correction lower for stock markets

- Potential opportunity for short sellers to profit off the correction lower

- Downside potential for short sellers -500 to -1,000 points

- Risk for short sellers from current market price seen at 750 points

Technical Analysis

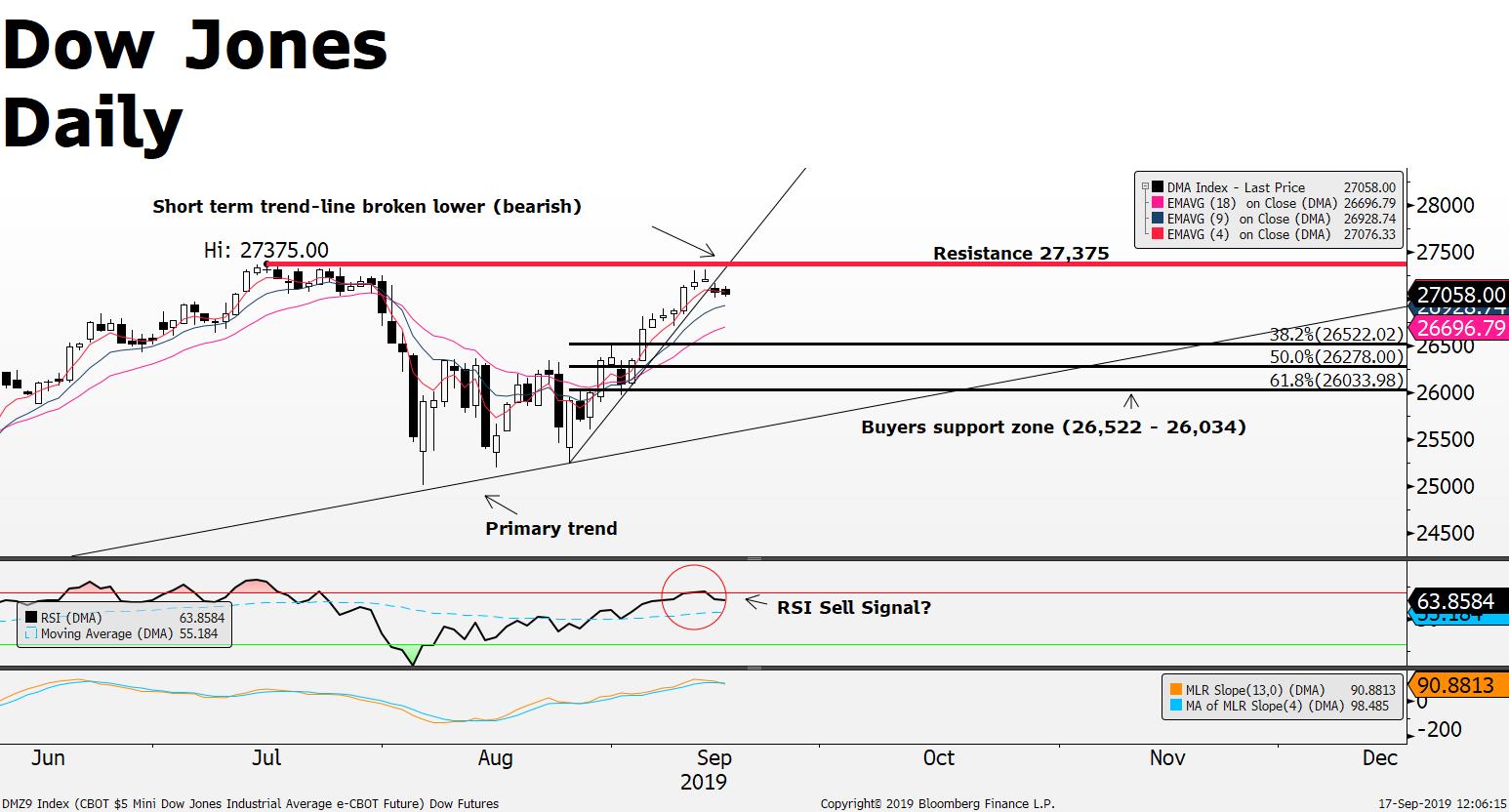

Sell signals spotted on the Dow Jones daily chart; primary trend is an uptrend (see chart) however, the short term trend is lower since price has broken to the downside of the short term 6 week uptrend line; the fact that price has advanced at a high rate over the last 30 days (+9%) indicates potential remains for a price correction lower towards the 38.2 - 61.8% retracement levels (see chart); short selling the Dow Jones Index is supported for potential targets 26,522, 26,278 and 26,033 ; alternative upside risk for short sellers is a break above 27,375;

Source: FXGM / Bloomberg