- In today’s Economic calendar we can expect to see some volatility in the EUR and USD

- At 9:00 (GMT), the Statistical office of the Eurozone (Eurostat*) will release their Gross Domestic Product (GDP)

- The GDP figure is a financial measure of the market value of all the final goods and services produced in a specific time period produced by the Eurozone.

- The result is expected in a decrease to -3.1%, considering that last month was 1%

- Also at 9:00 (GMT), the Statistical office of the Eurozone (Eurostat*) in addition will release their Unemployment Rate

- The result is expected in an increase to 7.7%, considering that last month was at 7.3%

- Furthermore, at 9:00 (GMT), the Statistical office of the Eurozone (Eurostat*) will release their Consumer Price Index (CPI*)

- The result is expected in an decrease to 0.7%, considering that last month was at 1%

- At 11:45 (GMT), the European Central Bank (ECB*) will announce their Interest Rate decision

- The result is expected to remain unchanged, the same as the previous month at 0%

- At 12:30 (GMT), the United States Department of Labor will release their Initial Jobless Claims

- That figure counts how many people are filing to receive first-time claims for unemployment insurance benefits for state unemployment insurance.

- The result is expected in a decrease to 3500K, considering that last month was at 4427K

* Eurostat is the statistical office of the European Union, liable for disclosing high-quality Europe-wide statistics and indicators that allows comparisons between countries and regions.

*The Consumer Price Index (CPI) measures and analyses changes in the price level of a weighted average market basket of consumer goods and services obtained by households, which is determined by taking price changes for each item in the predetermined basket of goods and averaging them.

*The European Central Bank (ECB) is the central bank for the Euro and conducts monetary procedures within the Eurozone, it comprises of 19 member states of the European Union, and is one of the largest monetary areas in the world.

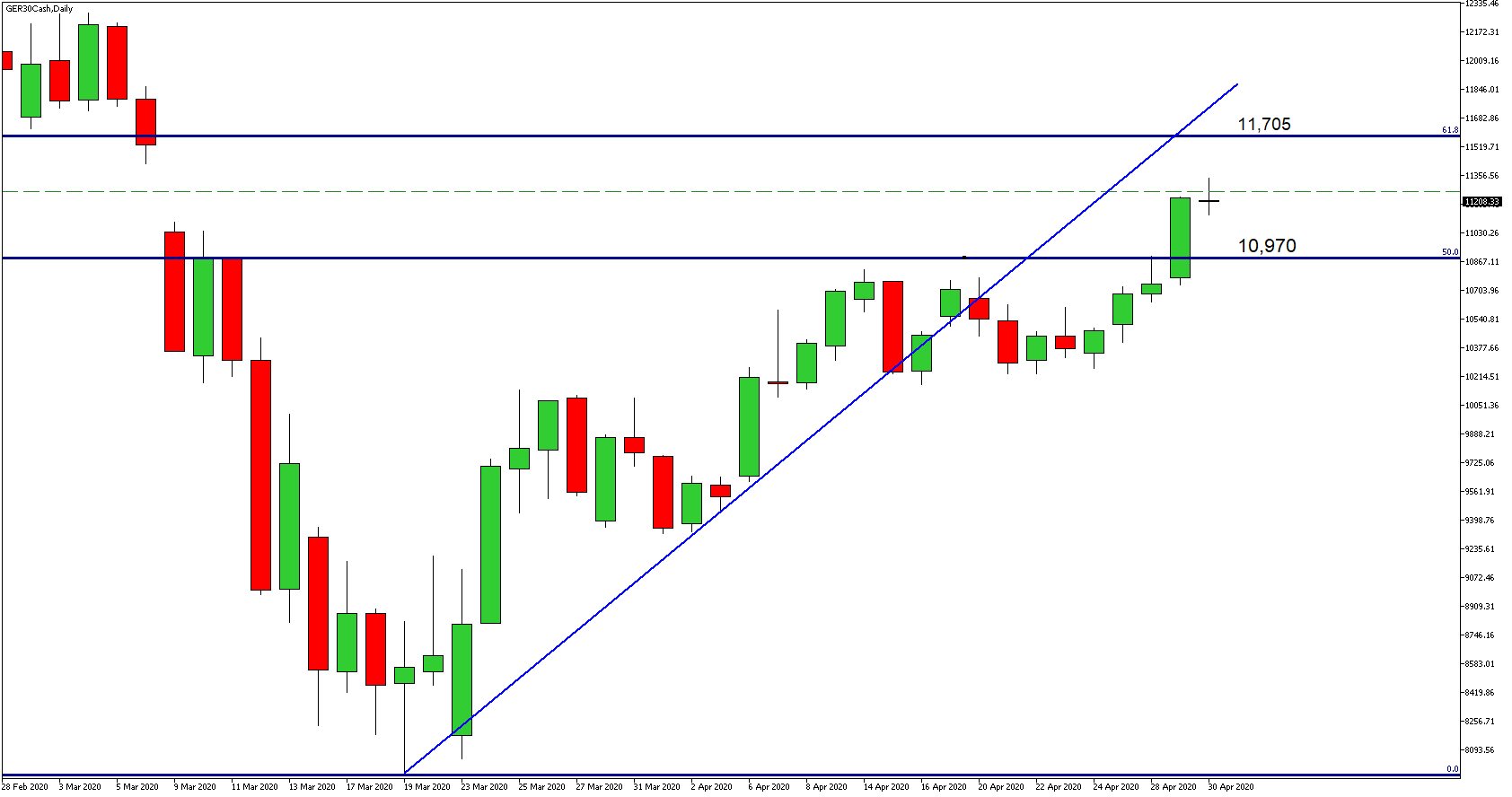

On the Charts

- As we can observe on the DAX 30 daily Chart, the price is now at 11,220.

- The Index reacted to the previous inside resistance (green dashed line).

- Even though the price is below the blue upward trendline, it is still moving to the upside.

- We may see the price moving higher to test the 61.8% Fibonacci Retracement Level (From 13,826 to 7,949) at 11,705.

- Otherwise, there is a possibility to see the price testing the 50% Fibonacci Level at 10,970.