Crude Oil Technical Analysis

- In today’s Economic calendar we can expect to see some volatility in the EUR and USD.

- At 08:00 (GMT), the Eurosystem will announce their Euro zone Bank Lending Survey (BLS).

- The BLS main objective is to improve the Eurosystem's familiarisation of bank lending conditions in the Euro zone, it implements information for the ECB Governing Council's assessment of monetary and economic developments, on which it supports its monetary policy decisions.

- At 12:30 (GMT), the Bureau of Economic Analysis of the USA will release their Good Trade Balance.

- That figure indicates the difference in value between imported and exported goods during a certain month.

- The result is forecasted in decreasing to -62.67B, considering that last month was at -59.89B.

- At 14:00 (GMT), the Conference Board of the USA, will release their Consumer Confidence

- That figure specifies the level of confidence that individuals have in economic activity.

On the Charts

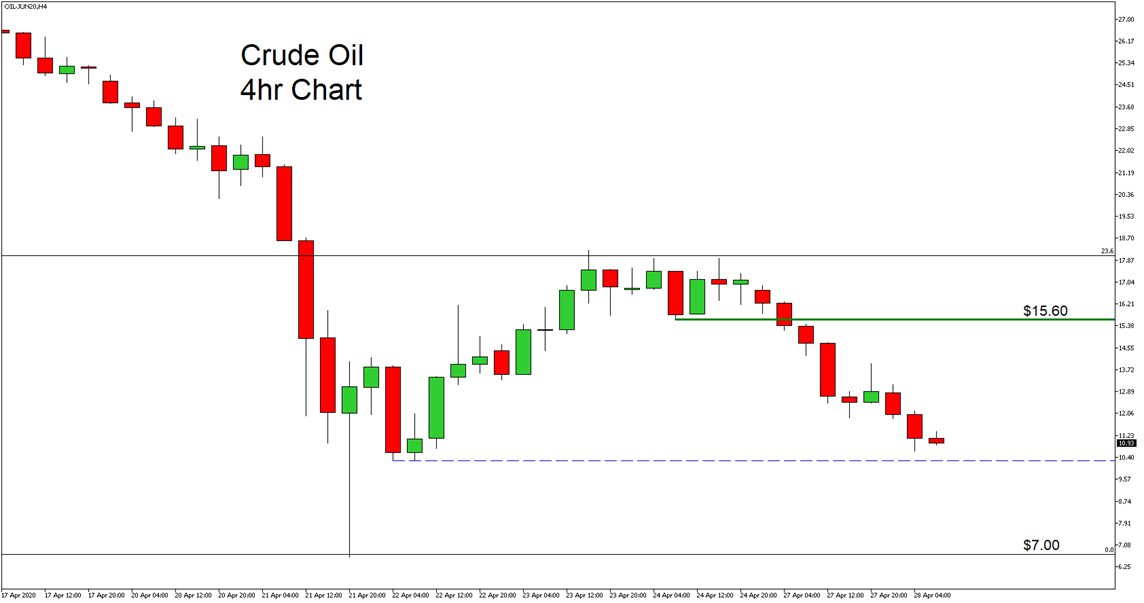

- Crude Oil price is now at $10.90.

- The Price after the huge drop of last week, it reacted to the upside, but found resistance at 23.6% Fibonacci Retracement Level at $18

- The price is approaching the previous support level at $10.30, the blue dashed line

- If we observe a breakout below that level, there is a possibility we may see the price moving lower to re-test the $7.00 price level

- Alternatively, there is a possibility to foresee the price moving higher to the inside resistance at $15.60