- In the economic calendar of today we can expect some volatility in GBP, EUR, CAD , Crude Oil and USD

- At 06:00 (GMT) the National Statistics office of United Kingdom, announced their Consumer Price Index (CPI)

- CPI is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services

- The result has decreased to 0.8%, considering the last month that was at 1.5%

- At 11:45 (GMT) the European Central Bank will announce their Interest rate decision

- The previous result was at 0%

- At 12:30 (GMT) the Bank of Canada will announce their Consumer Price Index Core

- “Core” CPI excludes fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products

- The result of the previous month was at 1.6%

- At 14:30 (GMT) the Energy Information Administration will announce the Crude Oil Stocks Change

- The result is forecasted to increase to 0.967M considering the last month that was at -0.745M

- At 18:00 (GMT) the Federal Open Market Committee (FOMC) will have a meeting to review the economic and financial condition of USA

- FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

On the Charts

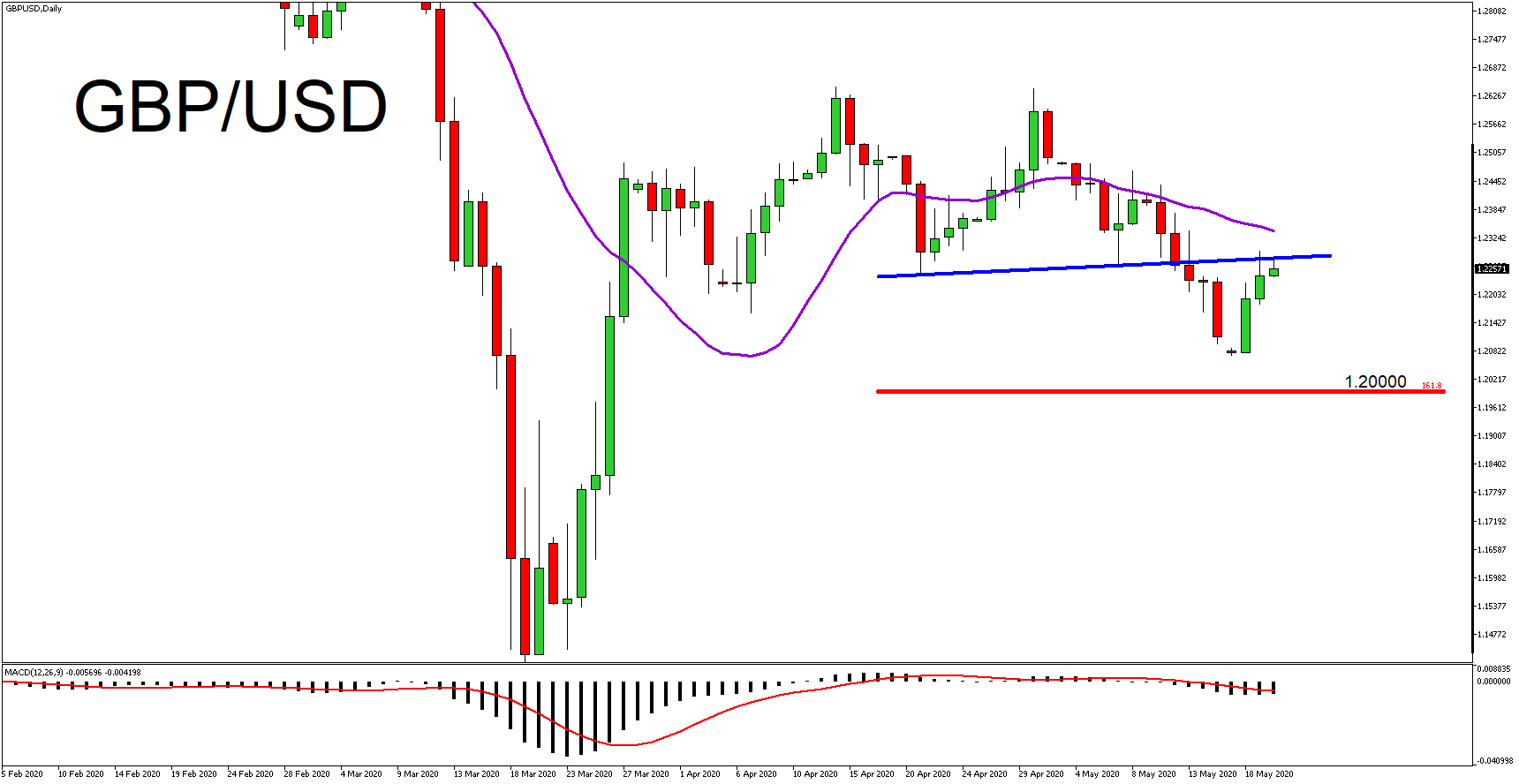

- As we can observe on the GBP/USD Daily Chart the price has formed a double top formation

- The price has broken the blue neckline of the formation to the downside and now is retesting it

- The pair’s price is now at 1.22571, below the 20 days Moving Average (purple)

- MACD has crossed its signal line to the downside while both are below zero

- Considering the above we may see the price moving lower at 1.20000, a price level which consists the 161.8% Fibonacci Extension Level (From 1.22461 to 1.26515)