- In the Economic calendar of today we can expect some volatility in CHF, GBP and USD

- At 07:30 (GMT) the Swiss National Bank will announce their Interest rate decision

- The result is forecasted to remain the same as the previous quarter at -0.75%

- At 11:00 (GMT) the Bank of England will announce their Interest rate decision

- The result is forecasted to remain the same as the previous month at 0.1%

- Also, at 11:00 (GMT) the Bank of England will release their Asset Purchase Facility

- The above, is the value of money the Bank of England plans to create and inject into the economy through open market bond purchases to influence long-term interest rates

- The result is forecasted to increase to 745B considering the last month that was at 645B

- At 12:30 (GMT) the US Department of Labor will release their Initial Jobless Claims

- The above is a measure of the number of people filing first-time claims for state unemployment insurance

- The result is forecasted to decrease to 1300K considering the last month that was at 1542K

On the charts

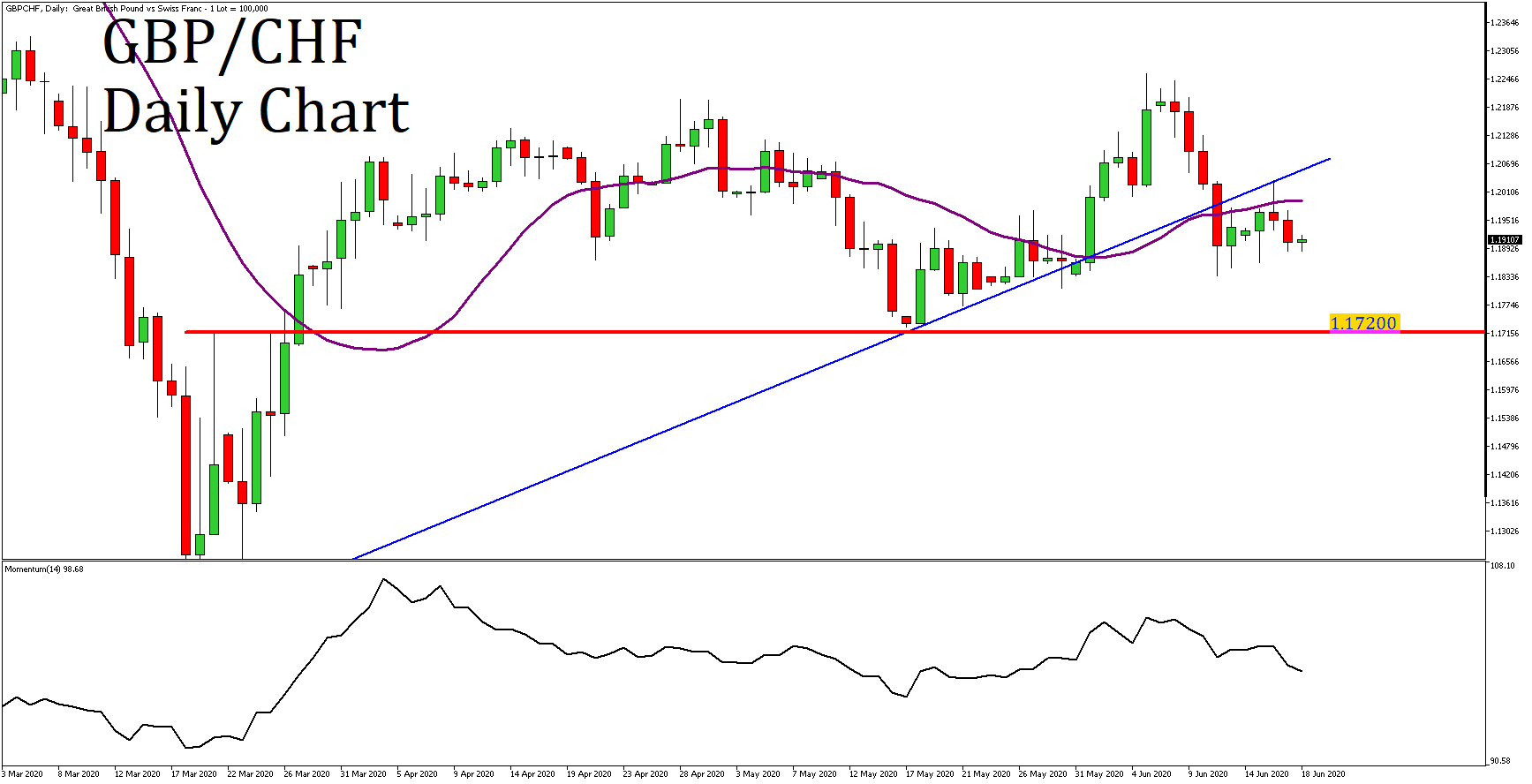

- As we can observe on the GBP/CHF daily chart, the price has broken below the blue upward trendline

- The price returned and retested the trendline and reacted to the downside

- The price is now at 1.19107 below the 20 days Moving Average (purple)

- In the momentum indicator we can observe that is heading to the downside below its previous support, indicating bearish attitude

- Considering the above, we may see the price moving lower to 1.17200, a price level which consists an inside support level