- In the economic calendar of today we expect some volatility in GBP, CAD, USD, Crude Oil and NZD

- At 06:00 (GMT) the National Statistics office of UK announced their Consumer Price Index

- The above is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services

- The result decreased to 0.5% considering the last month that was at 0.8%

- At 12:30 (GMT) the Bank of Canada will release their Consumer Price Index

- The result is forecasted to increase to 1.4% considering the last month that was at 1.2%

- At 12:30 (GMT) the US Census of Bureau will announce their Building Permits

- The above shows the number of permits for new construction projects

- The result is forecasted to increase to 1.228M considering the last month that was at 1.066M

- At 14:30 (GMT) the Energy Information Administration of US will announce their Crude Oil Stocks change

- The result is forecasted to decrease to 0.5M considering the last month that was at 5.72M

- At 22:45 (GMT) the Statistics office of New Zealand will announce their Gross Domestic Product

- The above is a measure of the total value of all goods and services produced by New Zealand

- The result is forecasted to decrease to -1% considering the last quarter that was at 0.5%

On the charts

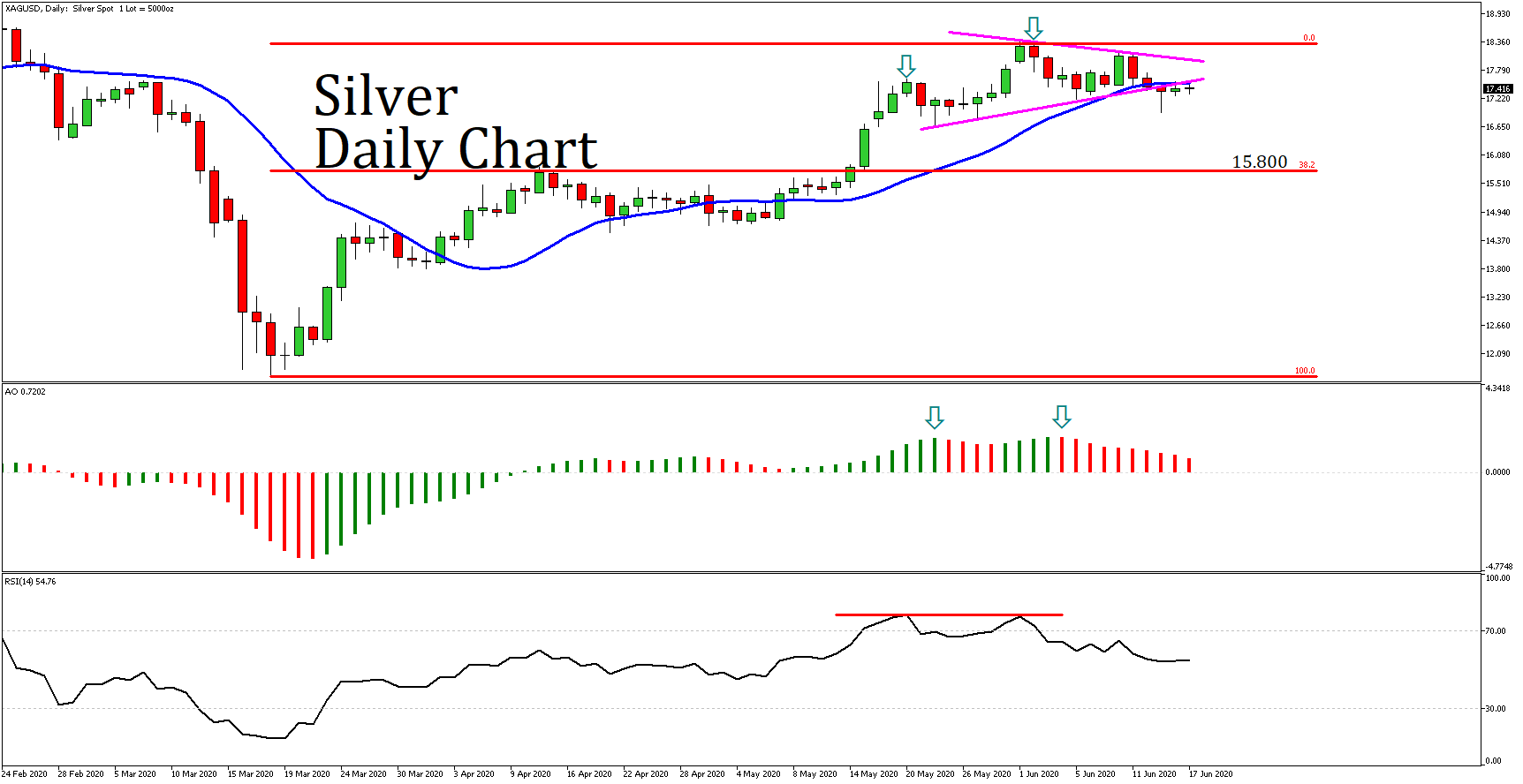

- As we can observe on the Silver Daily chart, a bearish wedge has been formed

- After a strong upward movement, the price found resistance at 18.300 price level and reacted to the downside

- The price is now at 17.416, below the 20 days Moving Average (blue)

- On the Awesome Oscillator we can observe a double top formation combined with a negative divergence, since the price created a higher top, but the oscillator failed to do

- Double Top we can also observe on the RSI, inside its overbought area

- Considering the above, there is a possibility to see the price moving lower to 15.800 price level, the 38.2% Fibonacci Retracement Level (11.627 – 18.331) and the inside support level