- In today’s economic calendar we can expect to see some volatility in the GBP, USD, EUR and CAD.

- In the morning, the Bank of England (BoE) announced their Interest rate decision.

- The new interest rates, which were imposed, remained unchanged as the previous month at 0.1%.

- At 09:00 (GMT), Andrew Bailey, the Governor of the Bank of England, will deliver a speech.

- At 12:30 (GMT), the United States Department of Labor will announce their Initial Jobless claims.

- The result is forecasted in a decrease to 3000K, considering that last month was at 3839K.

- At 14:00 (GMT), Christine Lagarde, the President of the European Central Bank (ECB), will hold a press conference analyzing how the ECB is examining the current and future state of the European economy.

- At 15:00 (GMT), the Richard Ivey School of Business in Canada, will announce their Ivey Purchasing Managers Index (Ivey PMI)

- The Ivey PMI is an important economic indicator which measures the month to month fluctuation in business conditions as indicated by a panel of purchasing managers from across Canada, and is processed by the Ivey Business School. Using end of the month data it covers all sections of Canada's economy.

- The result is forecasted in a decrease to 25, considering that last month was at 26.

On the Charts

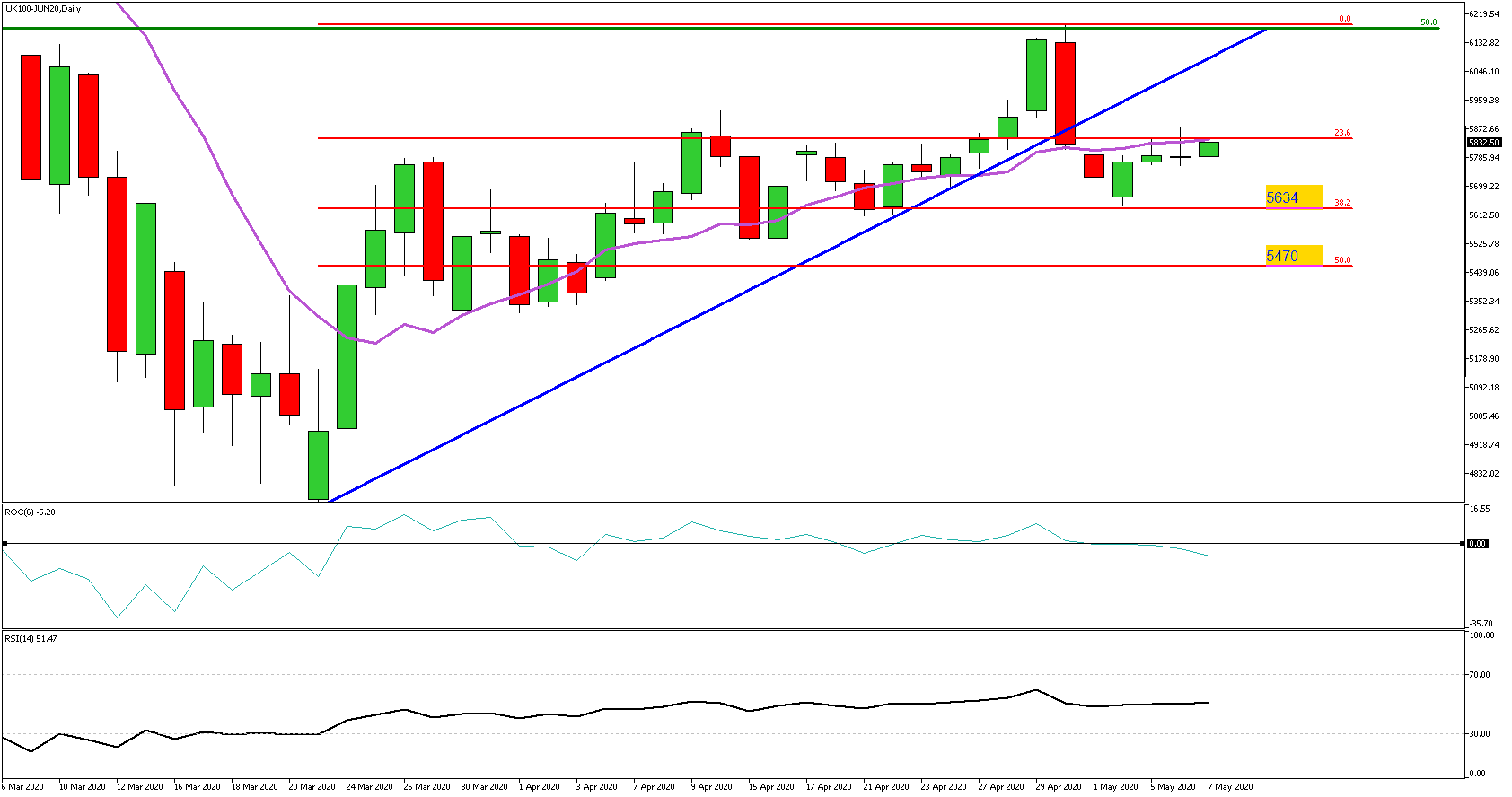

- As we can observe on the FTSE 100* Daily chart the price found resistance of the last month’s upward movement on the 50% Fibonacci Retracement Level (From 7622 to 4748).

- That point acted as a strong resistance and pushed the price aggressively to the downside.

- Now, the price is at 5842, below the blue upward trendline of 23.6% Fibonacci Level (From 4729 to 6185) and the 10 days Moving Average (purple).

- RSI* is flat in the last trading sessions, since price is trading sideways but ROC* of 6 periods is below zero.

- Considering the above, we may see the price react again to the downside and reaches the previous tested of 38.2% Fibonacci Retracement Level at 5634 or lower to 5470.