- In today’s Economic calendar we can expect to see some volatility in the EUR and USD

- In the morning, the European Countries announced their Markit Manufacturing Purchasing Managers’ Indexes (*PMI)

- The Manufacturing Purchasing Managers Index (PMI) released by Markit Economics captures business conditions in the manufacturing sector, and has a large impact on the total GDP*. Furthermore, the manufacturing PMI is an important indicator of business conditions and the overall economic condition.

- At 14:00 (GMT), the Census Bureau of USA will announce their Factory Orders for the previous month

- The result is forecasted in a decrease to -9.5%, considering that last month was at 0%.

* Gross domestic product or GDP, in short, is a monetary measure of the market value of all the final goods and services produced in a specific time period.

Global Indices as on Friday 01 May 2020:

- S&P 500: -2.81%

- Dow Jones 30: -2.55%

- Nasdaq 100: -3.14%

- DAX 30: -2.22%

- CAC 40: -2.12%

- FTSE 100: -2.34%

- IBEX 35: -1.89%

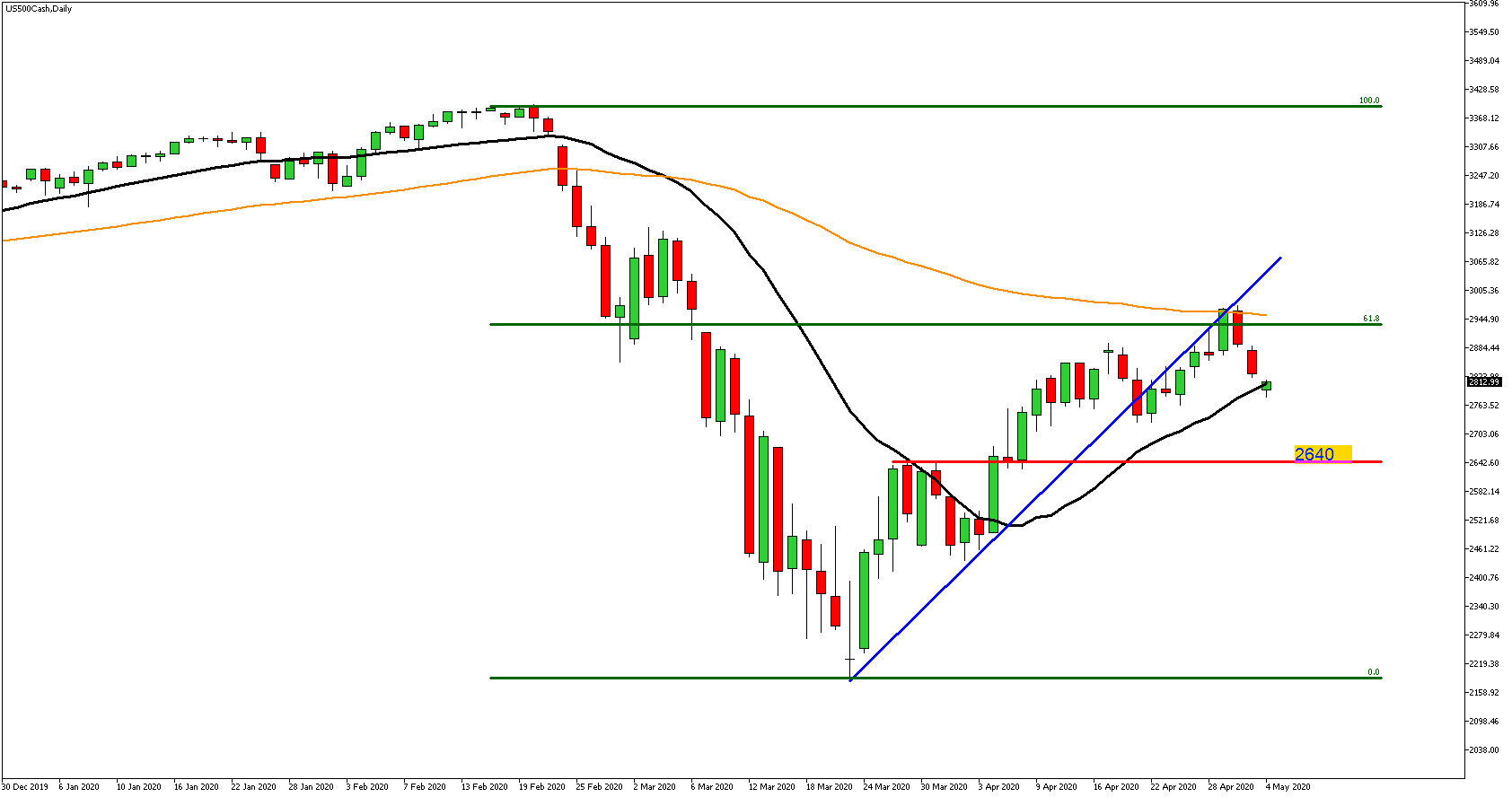

On the charts

As we can observe on the S&P 500 daily chart the price, after the break of the blue upward trendline returned and retested it

The price reacted on the trendline, on 61.8% Fibonacci Retracement Level (From 3392 to 2189) and the 200 days Exponential Moving Average (orange)

The S&P price is now at $2,800, currently below the 20 days Moving Average (black)

The Index today opened with a downside gap, where we may see the price filling that gap during the day, but overall there is a possibility to see the price moving lower, to the inside support level at $2,640