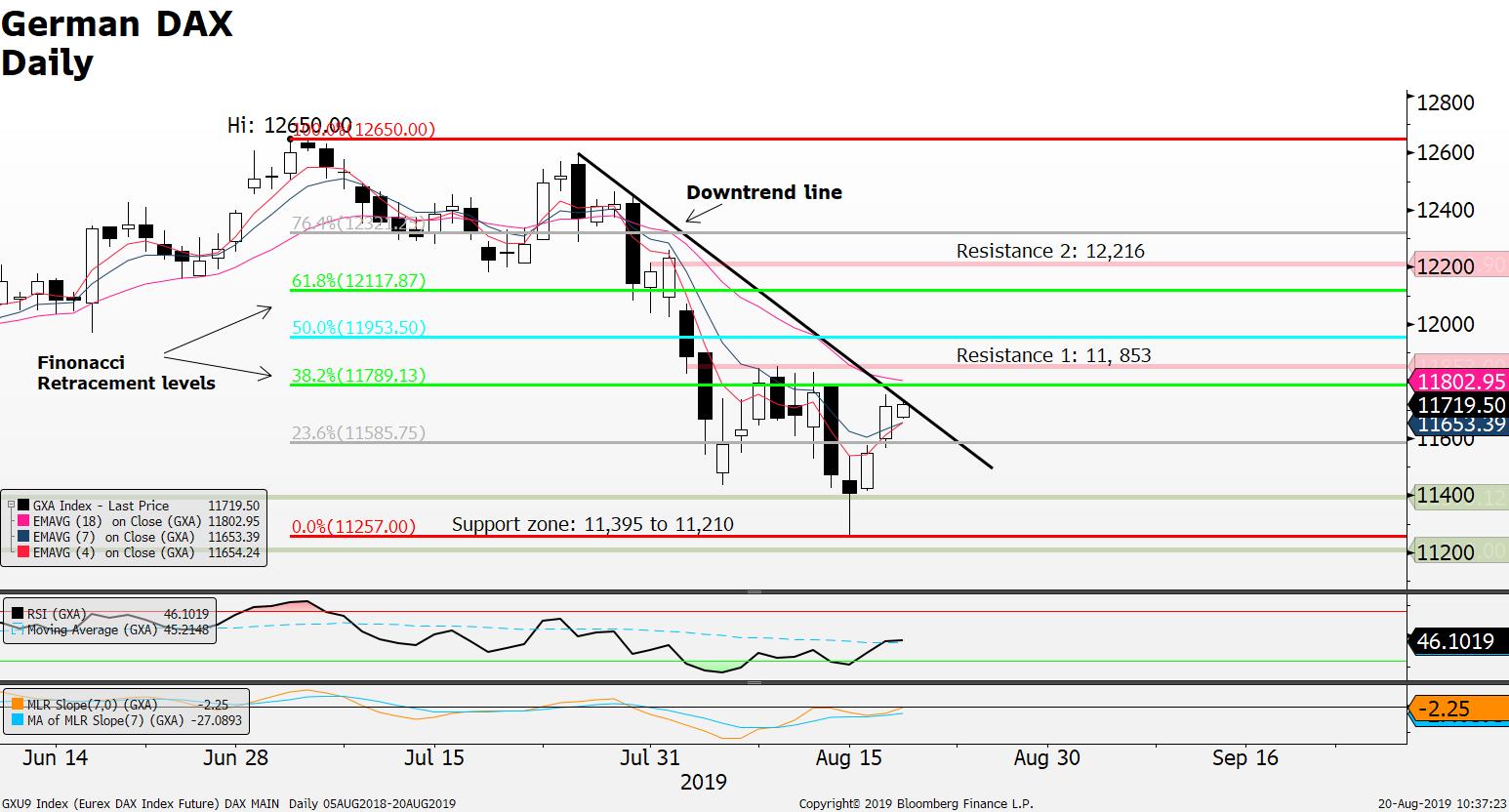

German DAX Index upside retracement move?; the index has potential to retrace the June high 12,650 to August low 11,210 move higher towards the 50-61% Fibonacci levels near 11,853 to 12,216 from current 11,700 price; provided price can hold above the 11,858 level,

What is a Retracement?

- A retracement is simply a short-term reversal in the trend, a move lower in an uptrend or a move higher in a downtrend;

- Buyers may look for retracements lower to enter new buy orders; while short sellers look for moves higher to open new short positions (Buy low / Sell High);

- The market rarely moves higher or lower in a straight line; markets zig-zag allowing traders to time trades adding or reducing positions near support and resistance levels;

- Traders aim to get into the market at retracement levels in order to take part in the larger move;

Key Themes Driving Markets

- Risk of Global Recession or Financial Crisis;

- Weaker European Inflation;

- US-China Trade War;

- Global Central Banks indicating to print more money;

Market Movers

- Technology stocks jump higher; US Fang Index gains +3.2% on Monday; however US Government Lawyers preparing to investigate ; Google; Facebook; Amazon and Apple for monopolies or unfair business practices; time to sell technology into strength or not?

- Corn and Soybeans higher; heavy rain in China flood field bad for corn and soy; corn price down -13% last 30 days RSI signals potential buy signal

- Crude Oil (CL) +3% last two days; worries about US – China trade war start to ease (again); CL to test the $57.50 resistance?? Current price $56.40; support moved higher to $53.60;

- Gold finding support above $1,490; current price $1,497; price supported on prospects global central banks will aggressively start printing money to ease any recession or financial crisis; can gold test the $1,535 recent highs?

Pending Events

- Federal Reserve minutes are published TOMORROW; the minutes will give insight on the decision to cut interest rates;

- Global central bankers meeting in Jackson Hole starts Thursday;

What is the Jackson Hole Economic Symposium?

Each year since 1978, the Federal Reserve Bank of Kansas City has sponsored a symposium on an important economic issue facing the U.S. and world economies. Symposium participants include prominent central bankers, finance ministers, academics, and financial market participants from around the world.

Gold finding support above $1,490; current price $1,498; price supported on prospects global central banks will aggressively start printing money to ease any recession or financial crisis; can gold test the $1,535 recent highs? A break above opens up the prospects to next leg up towards the $1,650 area;

Source: FXGM / Bloomberg