Market Update:

- EU and US Stock Indices lower ahead of US Fed Chief speak today and tomorrows US FOMC meeting minutes; investors waiting for clues on the direction of interest rates;

- European stock indices trading sideways as investors look for clues on the next move; stock prices seen consolidating the recent gains; some profit taking may also be adding to downside pressure; potential open for break-out moves in either direction upon completion of the consolidation phase;

- Commodities prices under pressure on concerns over uncertain global economic outlook; this week’s US Fed speeches and tomorrows FOMC meeting minutes could provide the catalyst for market direction;

- Currencies; EUR/USD down -75 pips last 5 days on speculation the US Fed may not cut rates as fast as expected; US Dollar index +1% last 30 days indicating that investors and traders still bullish on the USD against the majors even as the risk of lower US interest rates remain;

Day Ahead

- US Fed Chairman Powell due to speak Today; he has more influence over the US dollar’s value than any other person; traders should be on alert for hints regarding future interest rates;

- US JOLTs Job Openings; a reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD;

Tomorrow

- U.K. GDP; Canada Interest Rate decision and US Federal Open Market Committee (FOMC) Meeting Minutes; Levi Strauss & Co. earnings and Crude Oil Inventories due Wednesday;

Upcoming Earnings

- Goldman Sachs reports on July 16th (next Tuesday); forecasted to earn $5.212 per share (EPS) on $9.048.375 billion in sales;

Charts

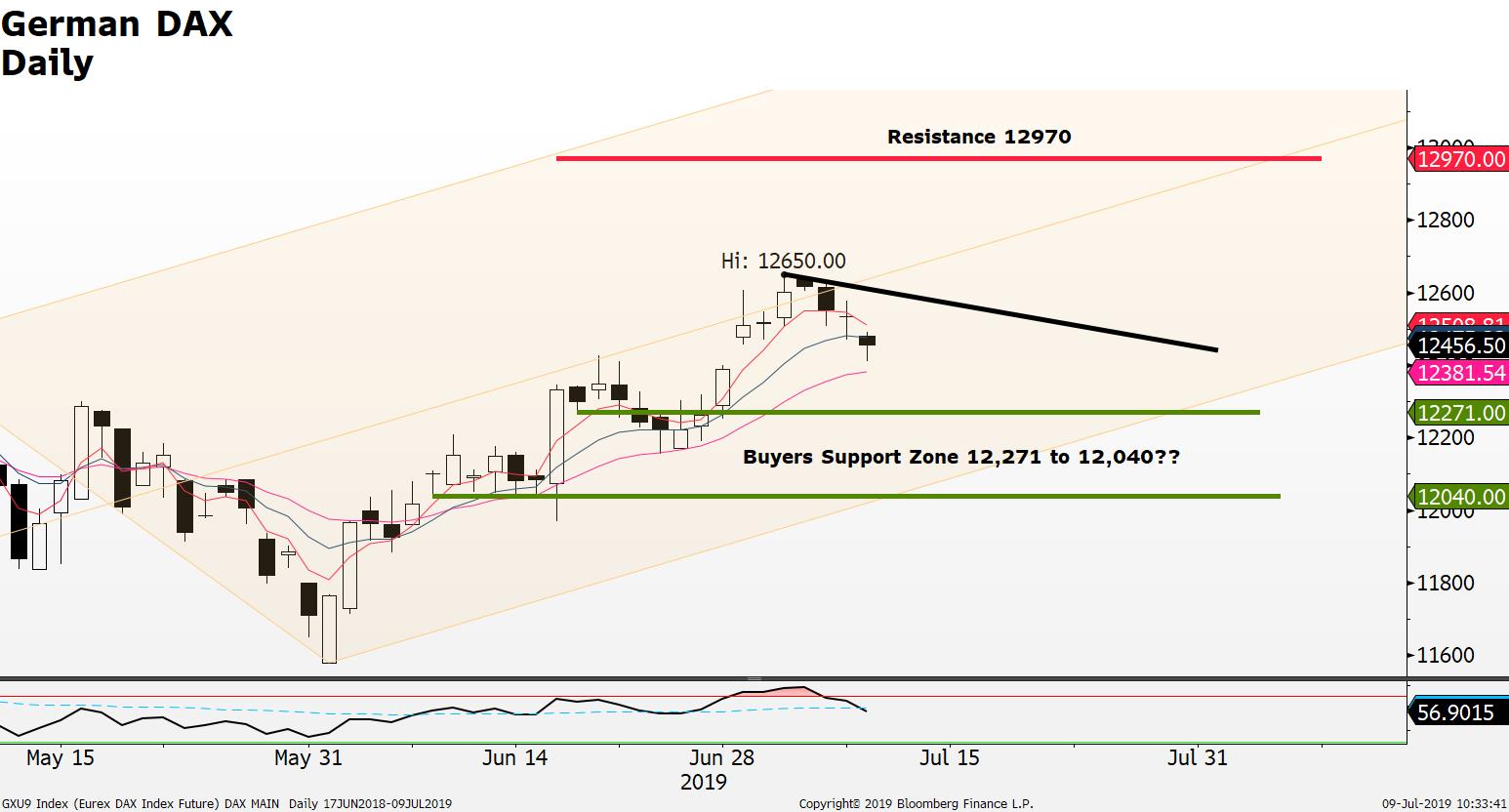

German DAX current price 12445 trading below its short and medium term 4 and 9 period moving averages ; RSI crossed below its 70 signal line (bearish) indicates downside pressure; despite the current multi-month uptrend remains intact prices may fall lower towards the 12271 – 12040 zone for buyer support before attempting to continue the current uptrend;

Norwegian Krone and Canadian Dollar in focus; downside pressure on Crude Oil prices and the recent USD strength is supporting the case for a stronger USD/NOK and stronger USD/CAD; even as Norway Norges Bank may move to raise interest rates in September; USD/NOK breaks above key resistance 8.63 ; current price 8.6420 + 72 pips last 5 days; the break above 8.63 opens up potential for a further advance; however with the prospects of a NOK interest rate increase short sellers may be betting on a return to the lower end of the multi-month trading range near the 8.4250’s; upside potential on 8.63 break 8.80 to 8.90; downside on a failure to hold above 8.63 near the 8.4250 support; USD/CAD current price 1.3117; support 1.3069; resistance 1.3230;

Source: FXGM / Bloomberg