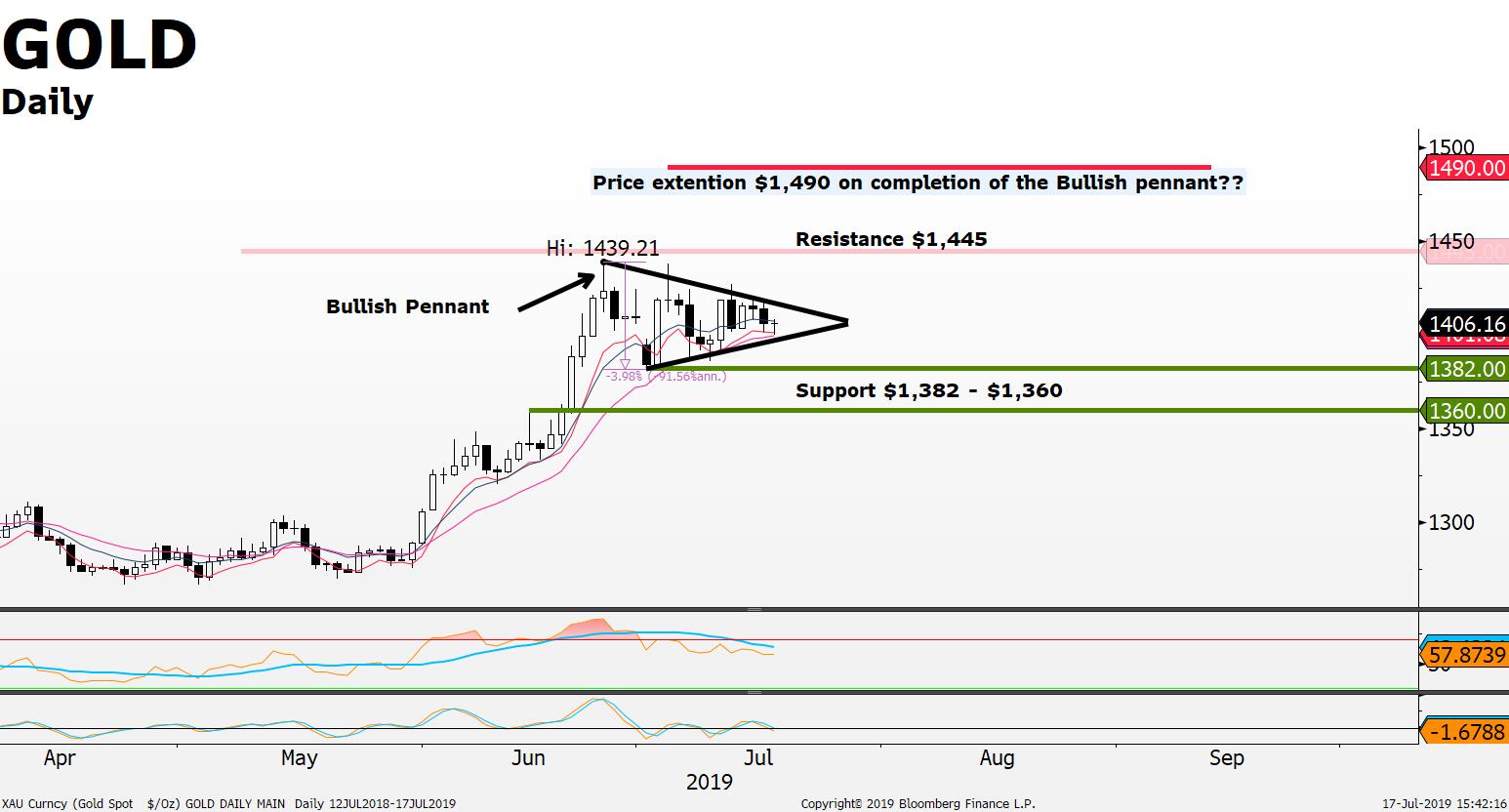

Gold price bullish pennant pattern in the works; a break out above the pattern will be the completion of the pattern for a potential price extension towards the $1,490; otherwise a failure for the pattern to be completed will open up supports $1,382 - $1,360;

Global Market Insights:

International stocks “pause recent uptrend” as Earnings Season Kicks In…

- Investors pause the recent stock buying frenzy as US stock indices hit new all-time highs; earnings and the upcoming July 31st US interest rate decision in focus;

- SP500 VIX Volatility Index near year lows; SP500; Dow Jones 30 and NASDAQ 100 at record highs; VIX Index could either be indicating that US stocks have further to advance or that the low volatility reading could be the calm before the storm….

Corporate Earnings due next two days:

- Tomorrow; Volvo; Nordea Bank and Telia; Index to watch OMX30 ( Nordic Exchange Stockholm); FX pair to watch EUR/SEK

- Friday; SSAB; Boliden and Microsoft; Indices to watch NASDAQ 100 and OMX30;

Earnings table next 6 trading day’s:

Charts

- Crude Oil prices down -4% last 5 days on fears of slowing global demand; current price $58 after failing to break above the $60.50 resistance; current price may be aiming to re-test the $56.60 support; price action on the daily chart indicates that CL is range trading between the $60.50 to $53.50 upper and lower ends;

Source: FXGM / Bloomberg