- US FED added economic stimulus by shifting policy towards lower interest rates;

- European Central Bank (ECB) signaled return to adding economic stimulus;

- Low inflation allows US and EU Central Banks to take the risk of adding economic stimulus without near term concern of overheating economies;

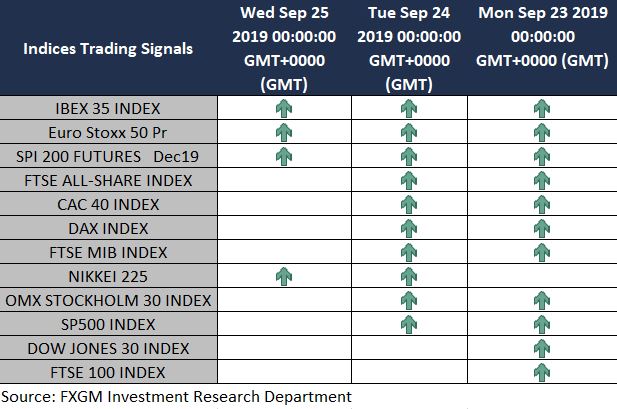

Stock Indices crawl up the wall of worry

- US Dow Jones gains over +5% last 30 days on bets the US FED interest rate cuts will offset uncertainties over the economic impact of its ongoing trade war with China;

- Eurostoxx 50 Index gains near +6% last 30 days as the European Central Bank (ECB) opens economic stimulus measures on concerns that the EU economic outlook is getting worse;

Bottom Line: Proactive Central Banks taking steps to support economies while major US and EU stock indices continue the longer term uptrend…..

The major US and European stock indices are trading near there all-time historic highs on bets that the US FED and the European Central Bank (ECB) will remain committed to aggressively boosting economies for as long as inflation remains within acceptable limits.

In an uptrend, Buy the dips and sell the rallies…