G-20 Meeting Bottom Line -

negative outcome has been avoided;

Global Stocks boosted higher;

Overview:

- U.S.-China trade war truce over the weekend boosts risk assets; Crude Oil +2.6%; Asian; EU and US stock index futures all sharply higher;

- Stock and energy traders enjoying Monday's good mood;

- Investors are jumping into stocks and other risk assets at the start of this week Asian trading session; after US and China Presidents Trump and Xi agreed to re-start trade negotiations;

- Japan Nikkei 225 +454 points (2.15%); European and US stock index futures all higher;

- Japan YEN weakens the US Dollar strengthens; Oil jumps +2.6% in a signal that investors see better global economic outlook;

- key market risk is that US FED expected interest rate cuts will not be as deep as markets are pricing in;

- Earnings season is approaching and any signs that trade wars are damaging profits and holding back profit outlooks will probably be on investors minds; traders should remain on higher alert when prices are within key resistance and support zones;

Charts

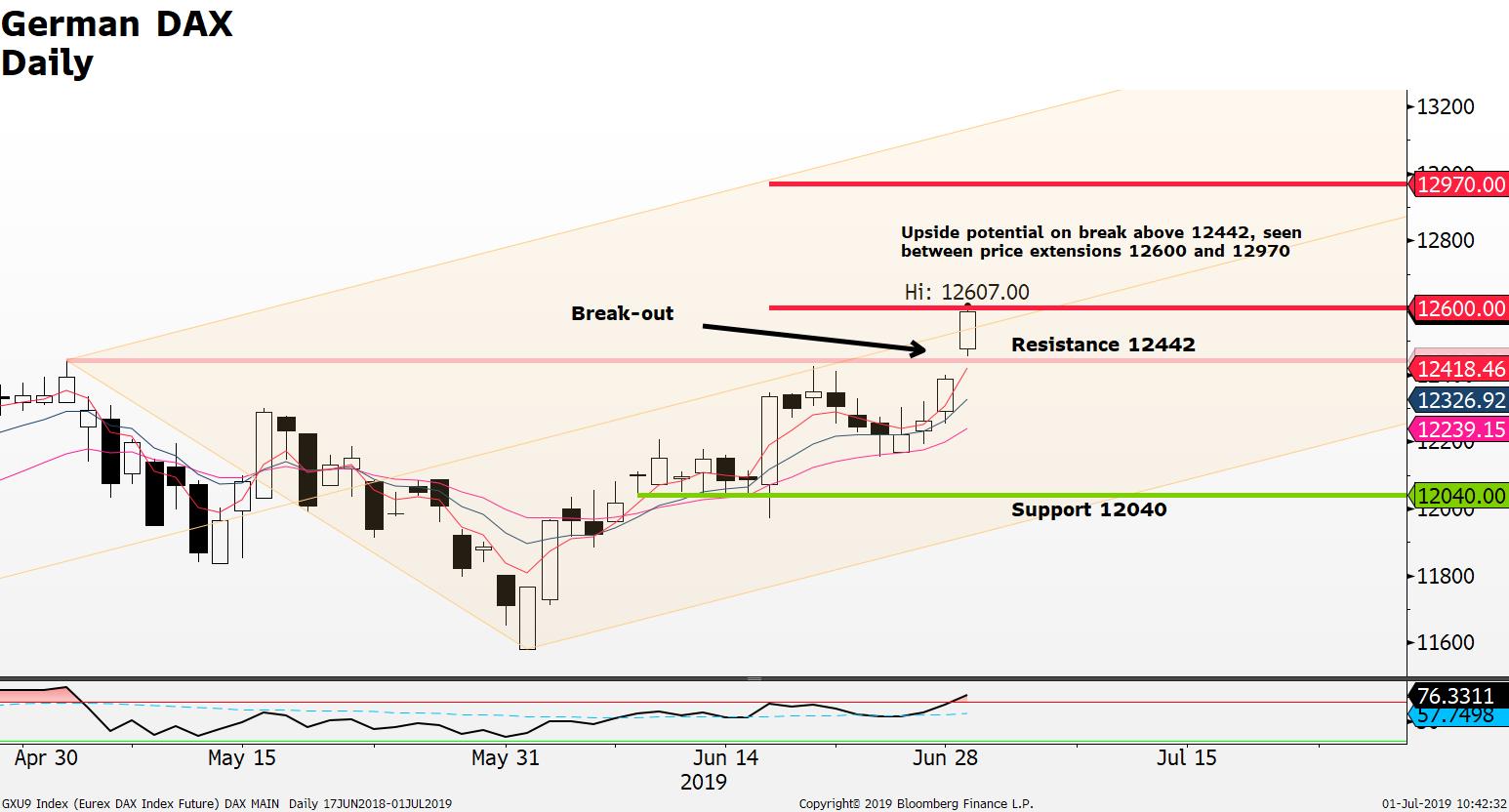

German DAX Gaps higher clears key resistance area (12,442); current price 12,567; RSI momentum indicator bullish; price extensions 12,600 to 12,970 remain in sight; however focus will shift to today’s European Purchasing Managers' Index (PMI) data; any downside surprise in the data may damage the current upbeat mood; provided 12,442 can hold and establish as support level upside potential remains;

Crude Oil (CL) prices nearing important resistance levels; Oil prices attempting to continue the upside recovery; however current price $60 faces resistance near the $60.50’s; Russia and Saudi Arabia boost oil prices higher after they agreed to continue to cut oil production for the next 6 to 9 months; crude oil prices also seen getting a lift from the G-20 meeting positive trade war truce between US-China; a break above the multi-month downward trendline (60.50) opens up the potential for a further move higher towards $63.60; downside support $56.60;

Italy's MIB finding resistance at 21,405 after Italian Manufacturing Purchasing Managers' Index (PMI) missed forecast; a break above 21,405 opens up potential technical extension towards 21,887 to 22,163; otherwise a test of 20,990 remains on the table...

French CAC40 following EU stocks higher; nearing 1 year highs after US - China trade war truce; focus now will be on economic data and upcoming earnings season for catalyst; current price 5581; resistance at 5613; a break above opens up potential price extension towards 5750 to 5855; otherwise a failure to establish new support above 5613 may call for a test of the 5460 support;

USD/JPY potential trend reversal to the upside; current price 108.30 challenging the prevailing multi-month downtrend line; resistance at 108.70 a break above opens up the potential for further upside; otherwise a failure to reverse the current downtrend will result in the continuation of the downside trend; current risk on mood helping to support the USD as traders shift out of safe haven currencies on news that US-China will re-start trade talks;

Source: FXGM / Bloomberg