- Latest Euro Area Manufacturing PMI data indicates EU Manufacturing and Services Sectors rebound;

- Surprise increase in Manufacturing PMI increased to 47 in August from 46.50 in July of 2019; however a reading below 50 indicates contraction;

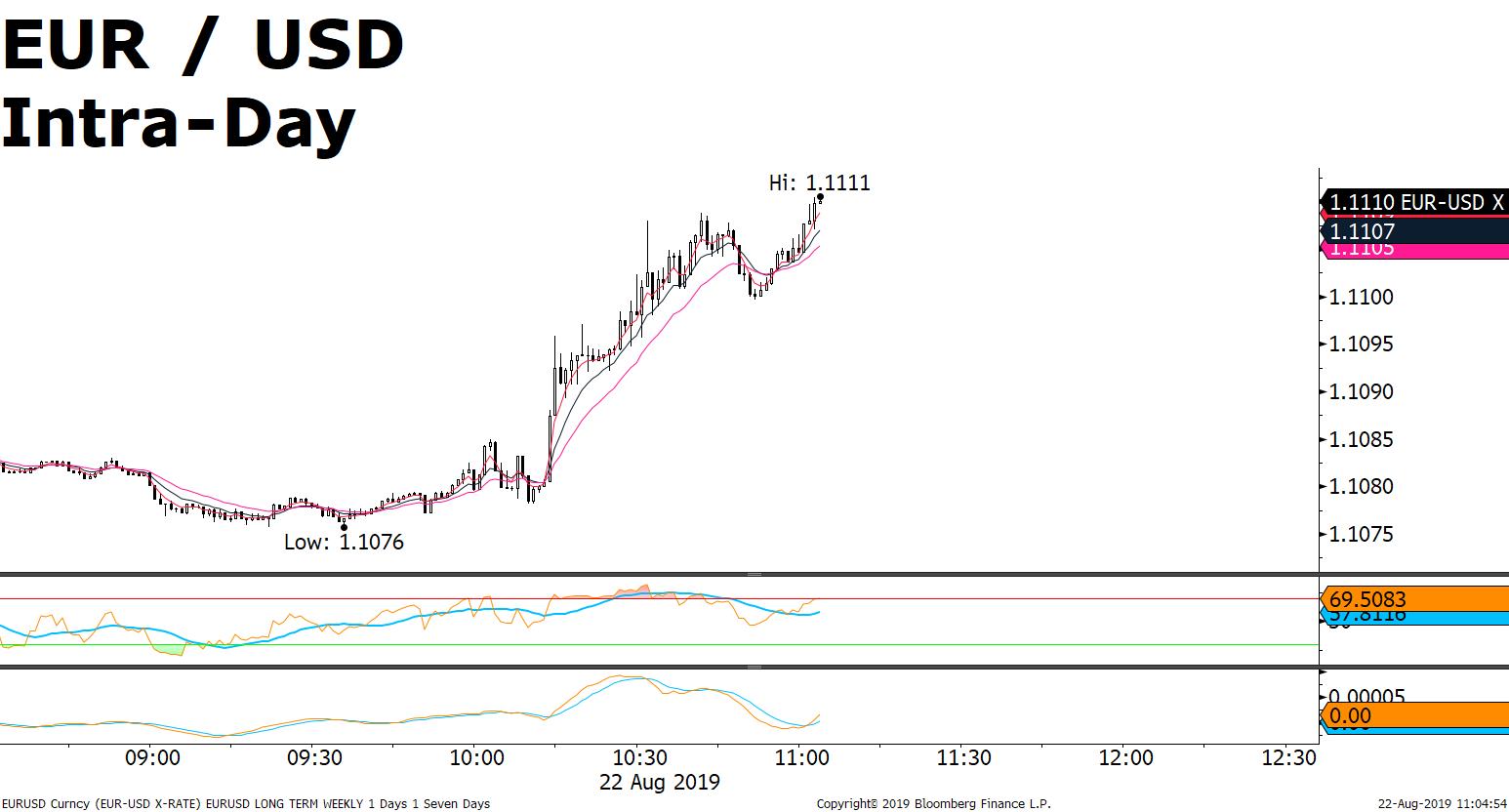

- EUR/USD jumps +40 pips higher from session low on the data;

EUR/USD (Daily Chart) potential for +300 pips on the upside towards the 1.14's from 1.1070 support? Early signs of a potential Non Failure Swing Bottom (Bullish Technical Analysis Pattern) in the works; key support area being established at 1.1070; current price 1.1104; Upside potential upon completion of the pattern indicated at the 1.1404 resistance; while downside support seen at 1.1070 and 1.1027;

- A failure swing is a pattern that technical analyst used to enter positions in anticipation of a trend reversal. In other words, a position is taken against the current trend. Buy signals in this case for the EUR/USD may occur on breaks above points B & D (Daily Chart);

- The pattern is deemed incomplete if price fails to hold above point C (Daily chart); a technical trader may then decide to abandon the idea of entering new longs and open new positions in the direction of the prevailing trend.

Source: FXGM/Bloomberg