Market Talk:

- US – China Trade War is on; currency wars to follow?; US Treasury Said China is manipulating currency market;

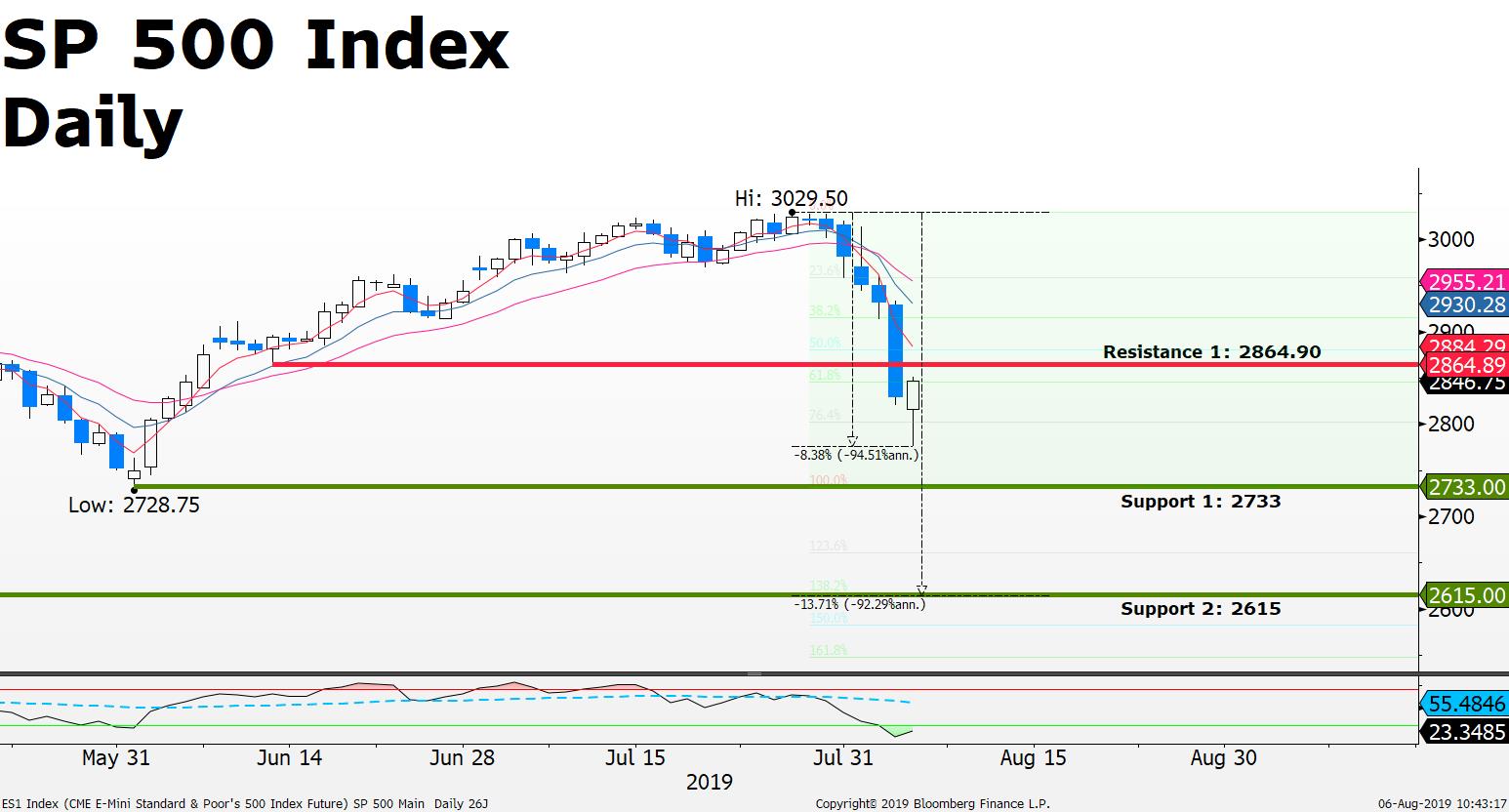

- Global Stock markets in a correction??

- If this is going to be a global stock market correction stock markets will have to fall further;

- A stock market correction is a decline of 10% or greater; US Dow Jones has falling -7% since hitting its all-time high in July; Eurostoxx 50 index down -9% since its July highs;

Don’t Panic Something for everyone:

- Aggressive short sellers seeking further downside for stocks may be looking to open new short positions on signs of any market strength;

- Short term aggressive traders with a feeling that markets may bounce higher after tumbling lower over the last 3 weeks; may be seeking to open new buy orders; in a market correction..... this is like trying to catch a falling knife...

- Longer term value buyers may be waiting for prices to fall further before starting to enter new buy orders;

Earnings Due Next 7 Day’s:

- Today is the last day to trade ahead of Wednesday’s Disney earnings; Tomorrow Walt Disney reports earnings before the US market opens; reports 3rd quarter earnings; forecast to earn $1.707 per share on $2.1440.412 billion in sales;

- Thursday; MTN Group; Adidas;

Charts

Reserve Bank of Australia (RBA) left interest rates at 1%; AUD/USD moves +65 pips after the interest rate announcement; AUD now moving off its lowest level in 10 years; the weaker AUD has helped act as a stimulus for the Austrian economy; downside seen towards the 0.6610 extension; while upside seen at 0.6930 provided price can clear above the 0.6830 resistance, current price 0.6785; downside momentum remains; however RSI testing the 30 buy signal line; RSI above 30 opens up potential upside for the AUD/USD;

NASDAQ 100 downside momentum remains; current price at light resistance 7446; short sellers may emerge near 7701 provide resistance breaks for a potential test of the 6965 support;

Crude Oil finds support at $53.70; current price $55.16; support $53.70; resistance $57;

Source: FXGM / Bloomberg