Continued Economic Expansion…. At Any Cost… Trump to Manipulate the US Dollar Lower??

If the US Federal Reserve chairman Powell fails to cut interest rates enough on Wednesday will the US dollar continue to strengthen? For the US President; a stronger USD is against his wishes; Donald Trump has long been complaining that economies like China and Europe are taking advantage of America by keeping their currencies low;

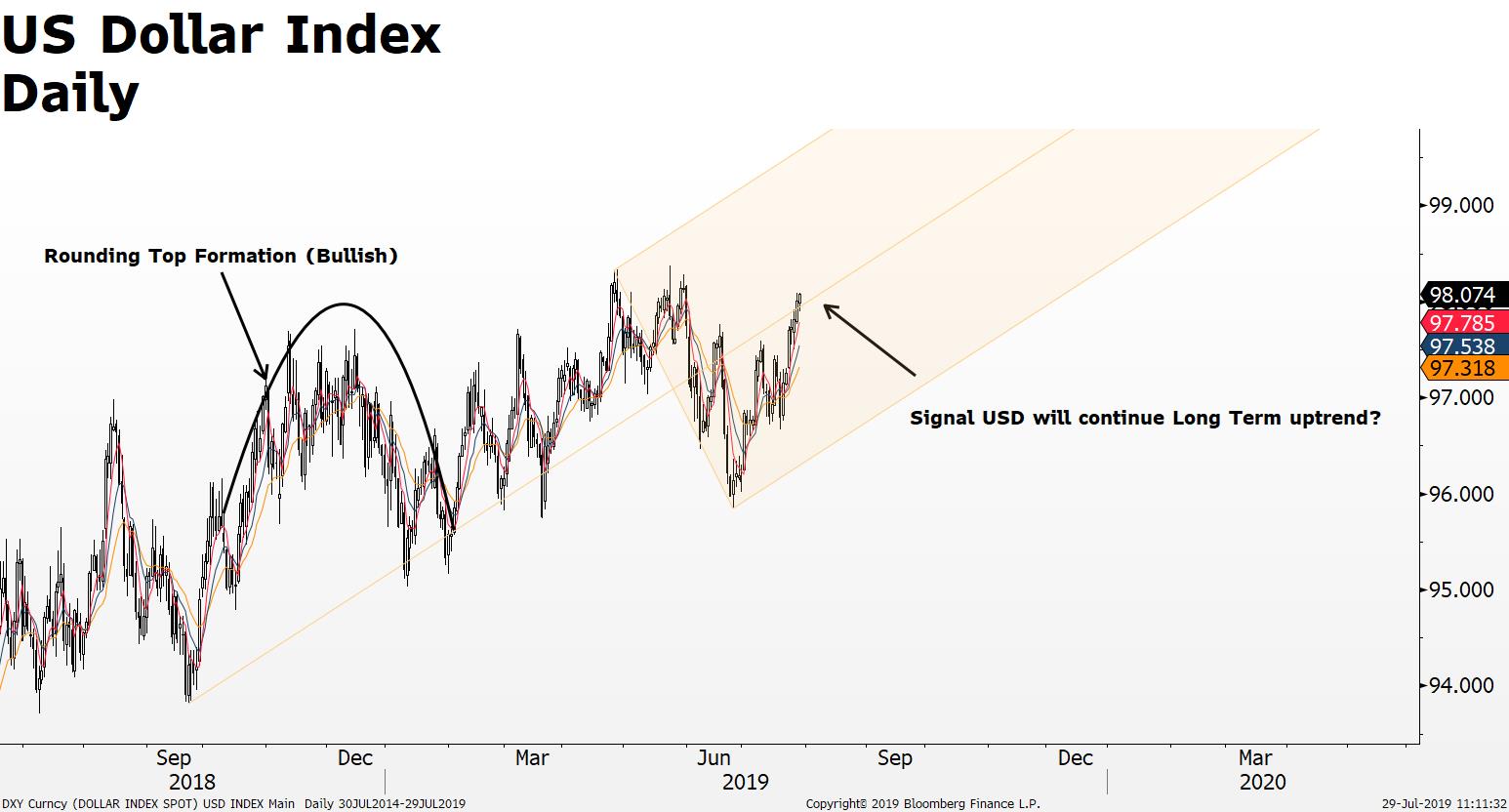

What does the US Dollar Index tell us?

The U.S. Dollar Index is an index of the value of the United States dollar (USD) against a basket of U.S. trade partners' currencies; EURO, YEN; GBP; AUD etc. The Index goes up when the U.S. dollar strengthens when compared to other currencies.

- Since September 2018 he US Dollar has gained around +4.5% against the majors;

- The US Dollar Index is a tool a trader may use for identifying trend direction of the US Dollar against any other pair and commodities prices;

- Weakening global growth supports the USD as a haven for low risk investors;

- Slowing US growth adds to speculation that the US Fed will cut interest rate; thereby reducing demand for the USD and a weaker USD may be the result;

Over the last 30 days the EURO is down -1.5% against the USD; GBP/USD is down -2.44%; AUD/USD is -1.64% lower; while Gold is +0.7% higher in USD terms.

The big bet for traders and investors is on the outcome of the US Federal Reserve Interest rate decision; according to financial reports, markets have already begun to price in a 0.25% USD interest rate cut....but...will a 0.25% cut be enough to slow down the US dollar's advance?

Remember...Trump and his need to keep stock markets high???

Is Trump bigger than market forces??

On Wednesday, do investors place bets against Trump and the US Feds plan for continued economic expansion...???

Time to go long? Go Short or Do Nothing?

Source: FXGM / Bloomberg