Big week for PMI Economic Data +

OPEC Meeting +

US Nonfarm Payrolls (NFP) due on Friday

Market Drivers:

In order for investors to be able to keep pushing stock markets higher; US - China trade tensions would have to improve; US job growth and consumer consumption would have to remain strong; and economic data needs to show signs that the recent Central Bank stimulus action from the world's major Central Banks is working. In this case, investors can bet on continuation of the decade long US stock market bull market.

Otherwise, if Asian, American and European real Gross Domestic Product (GDP) growth fails to expand during the first few months on 2020, there remains a risk that the Global economy may slip into a recession.

What is price action telling traders about the world's most popular stock index - the Dow Jones Industrial Average?

In this situation of uncertainty and conflicting news headlines, a trader may choose to rely on technical analysis tools. Applying Technical Analysis can help a trader to focus exclusively on price action while filtering out the noise of the day-to-day news headlines.

The Dow Jones is a leading stock index that tends to set the pace for the world's global indices to follow. With this in mind, we will make a brief technical analysis commentary on our CFD product Dow 20/12/2019:

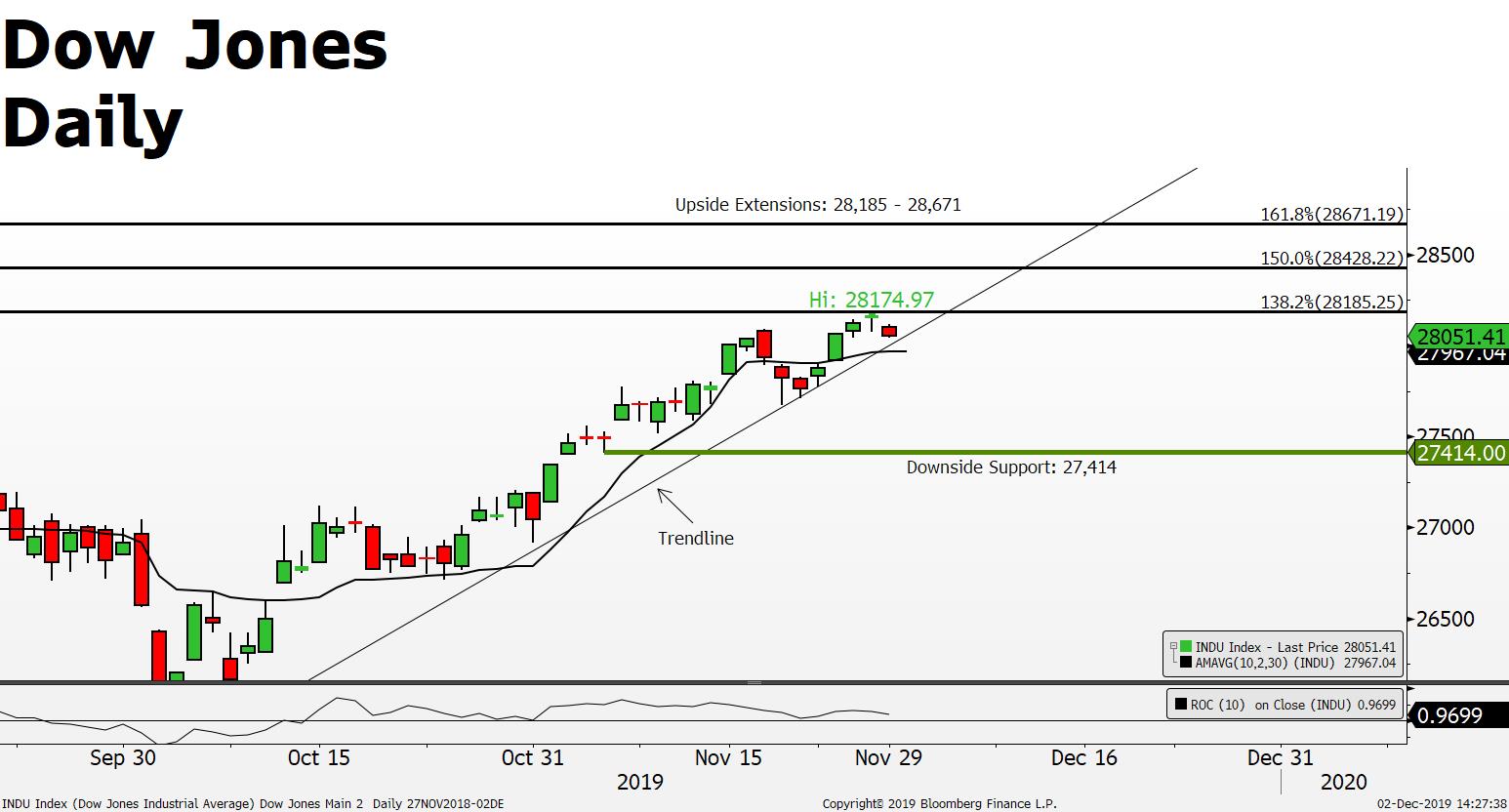

The Dow Jones Index (Daily Chart) trending higher since early October 2019 with higher tops and higher bottoms on price (uptrend); current price 28,051 is trading above its trendline, current price is also above its 10 period moving average (bullish); however, the index found resistance at 28,175; and with current price at 28,051, in order for the uptrend to continue higher towards extensions 28,428 - 28,671, price will have to successfully challenge and break above the 28,175 resistance level; otherwise a test of the lower downside support near 27,414 cannot be ruled out.

The Week Ahead:

Monday

Eurozone and United Kingdom Manufacturing PMI Data Beat Forecast.

- Eurozone Economies may have avoided a recession;

- Euro-Area Purchasing Managers (PMI) Index showed a slight improvement during November;

- Improved EU Manufacturing Sector outlook driving investors to speculate that the worst of the European Manufacturing slowdown has passed;

Tuesday – Australian Interest Rate

- Reserve Bank of Australia (RBA) Interest Rate Decision

- UK Construction PMI

Wednesday – US ADP Employment Change

- OPEC Meeting (Day1)

- Australian Gross Domestic Product (GDP)

- UK Services PMI

- US ADP Nonfarm Employment Change

- US ISM Non-Manufacturing PMI

- Canada Interest Rate Decision

- US Crude Oil Inventories

Thursday

- OPEC Meeting (Day 2)

- Australian Retail Sales

- Reserve Bank of India Interest Rate Decision

Friday – This Week Main Event

- US Nonfarm Payrolls expected to rise from 128,000 to 180,000 new jobs

Source: FXGM Investment Research Department / Bloomberg